HOW TO: Add Two Taxes or a Compounded Tax to an Invoice

© tashatuvango /Adobe Stock

Life can be complicated, and so can taxes.

We get it. Sometimes you need to add a tax to just a single item on the invoice. Sometimes, you need to add two taxes. And sometimes...you need to add compounded taxes.

Don’t worry, with Invoice Home you can do it all in a snap.

Here’s how!

Desktop

1. Sign in to Invoice Home here.

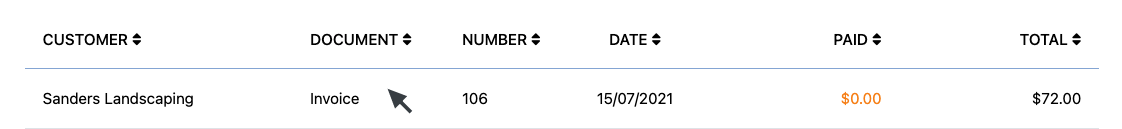

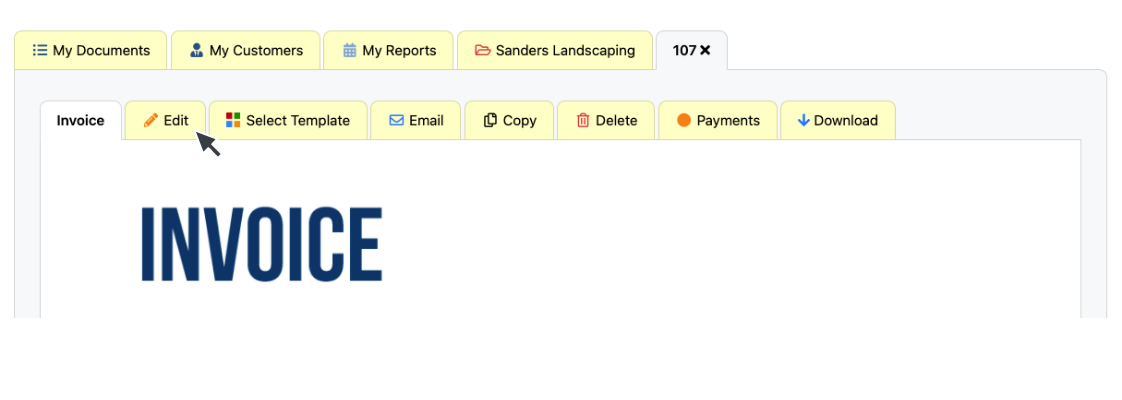

2. Create a new invoice, or open an existing invoice in your document list and click the edit tab.

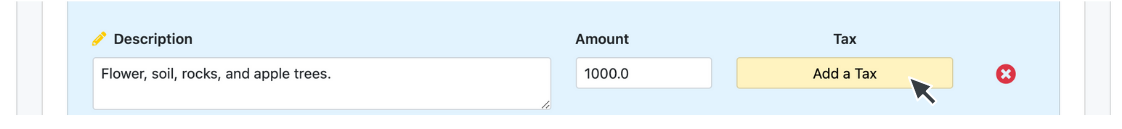

3. Click the "Add a Tax" button.

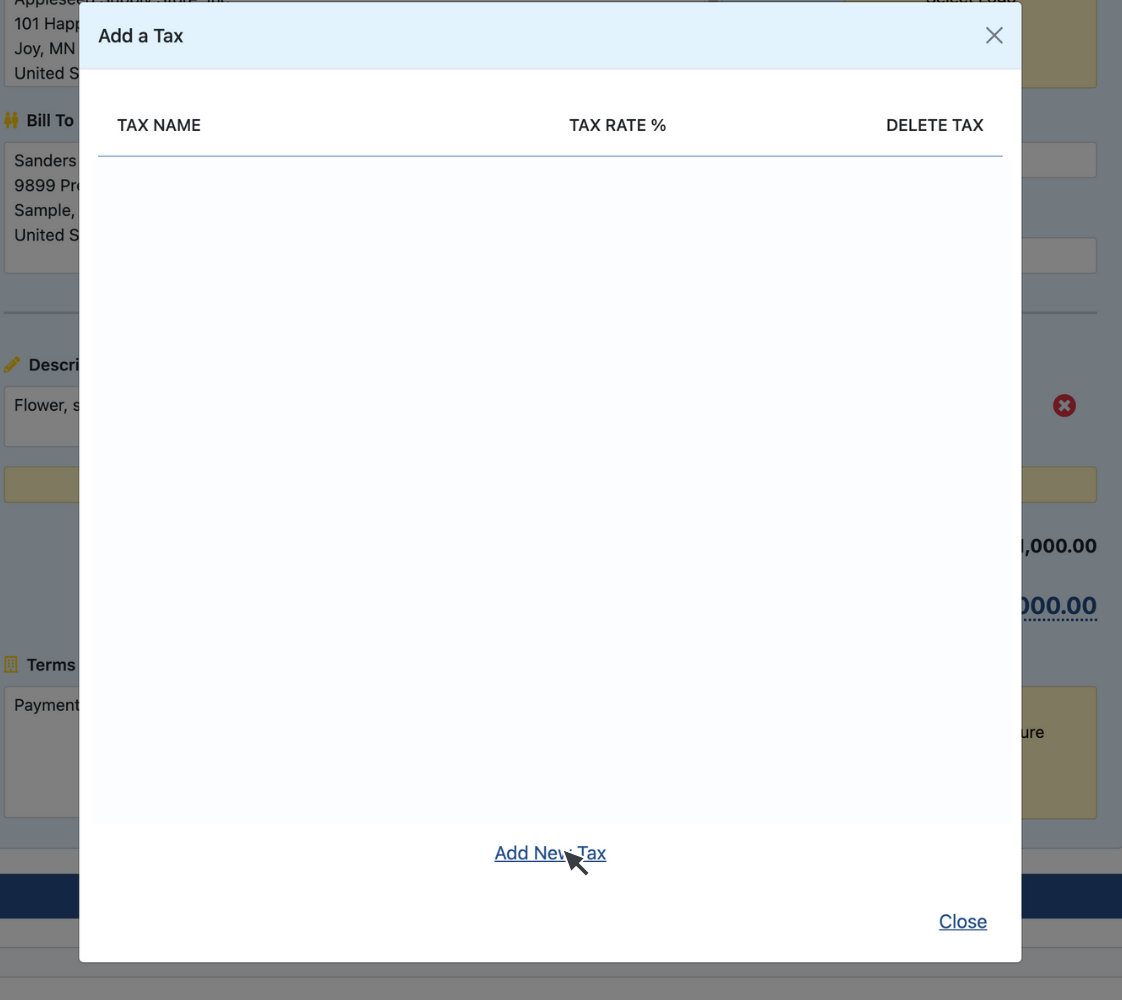

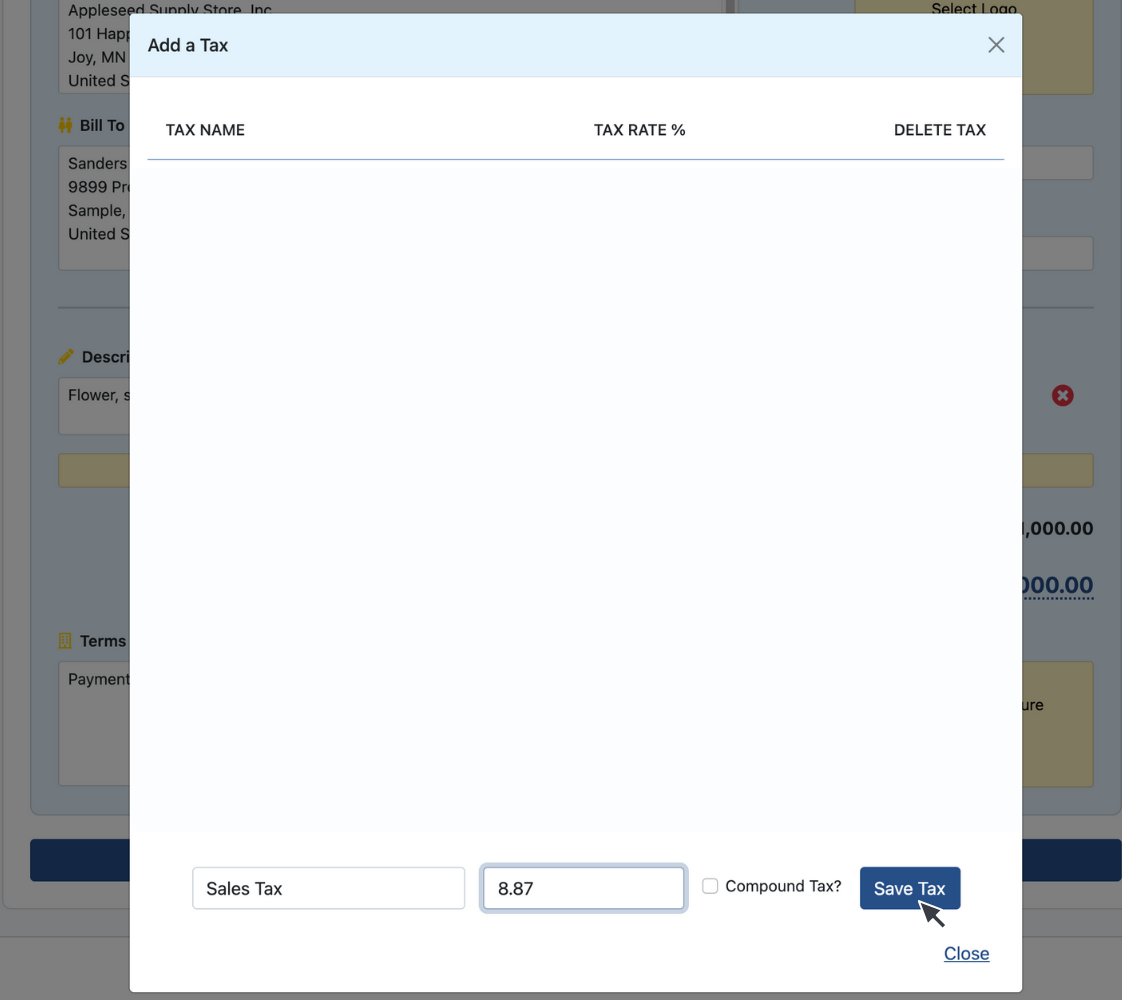

4. Click "Add New Tax".

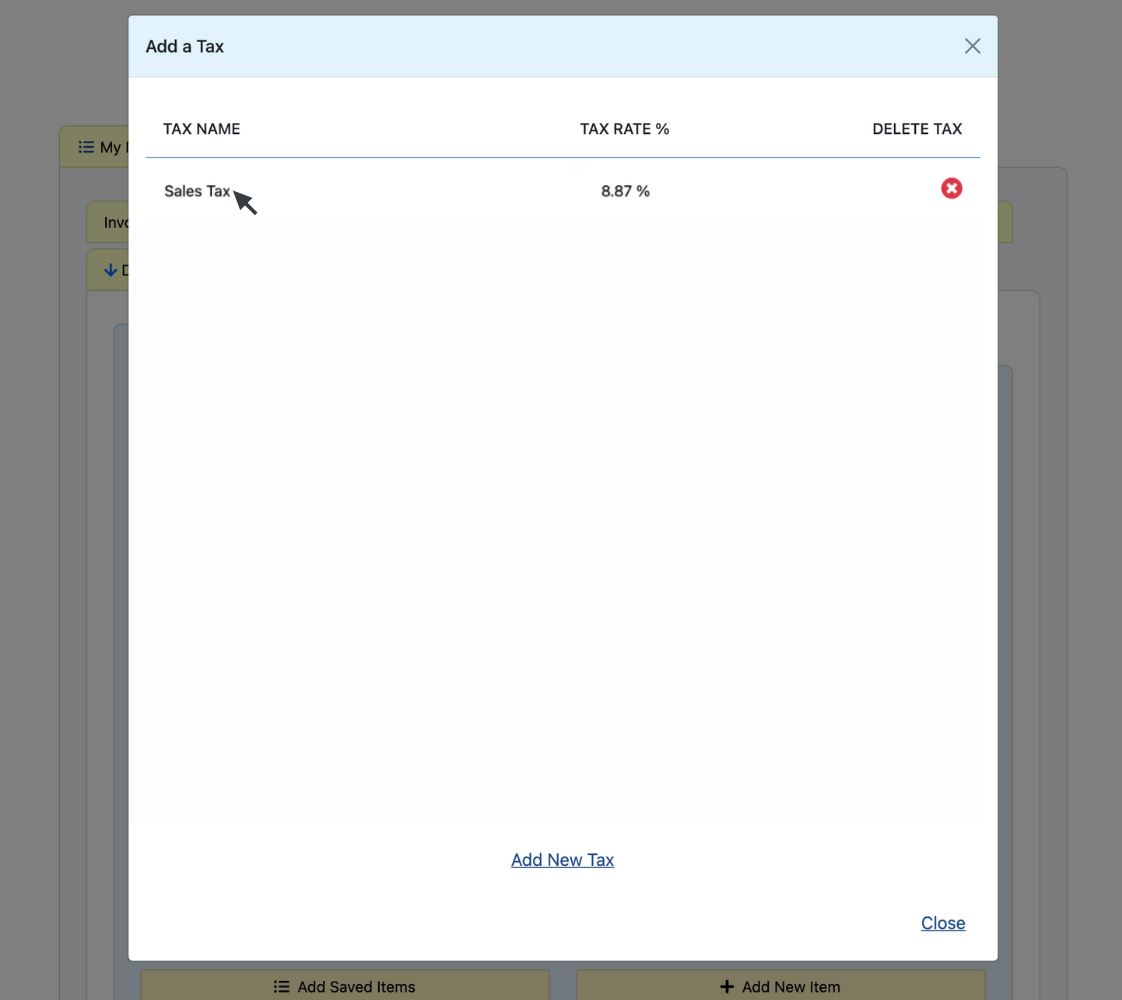

5. Enter the tax name, and percentage rate. Click "Save Tax".

6. Click on the name of the tax you created.

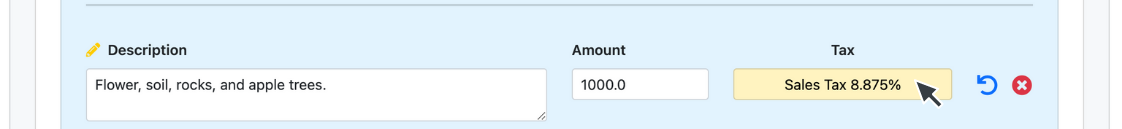

Note: Repeat this process for every item you want to apply the first tax to before adding the second tax.

7. To add a second tax, click on the tax button.

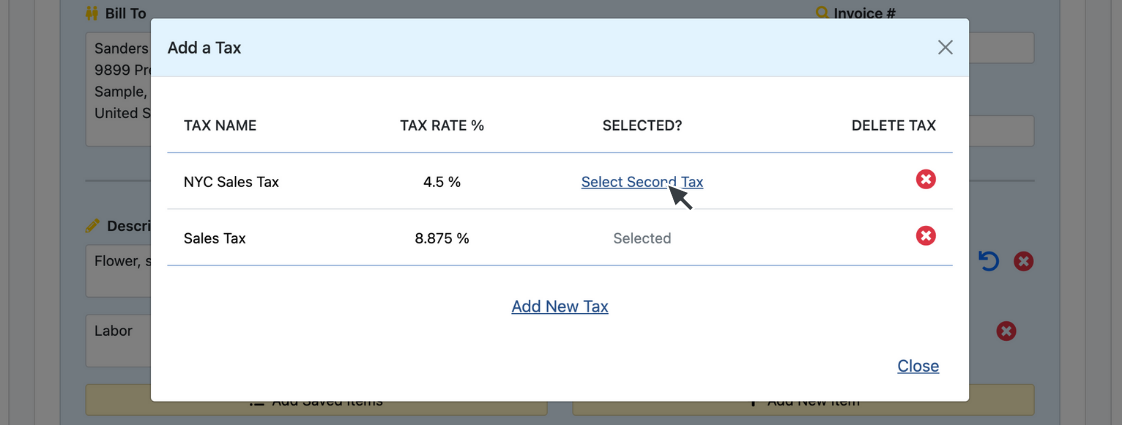

8. Create another new tax as instructed above, or from the list of taxes you previously created, click "Select Second Tax".

Note: If you need the second tax to be compounded, click the box next to "Compound Tax" when you create a new tax. A compound tax is only used in a few regions in the world, and it's calculated in addition to the primary tax.

Congrats! You’re done! Plus, the taxes you added are all saved so you can use them in the future.

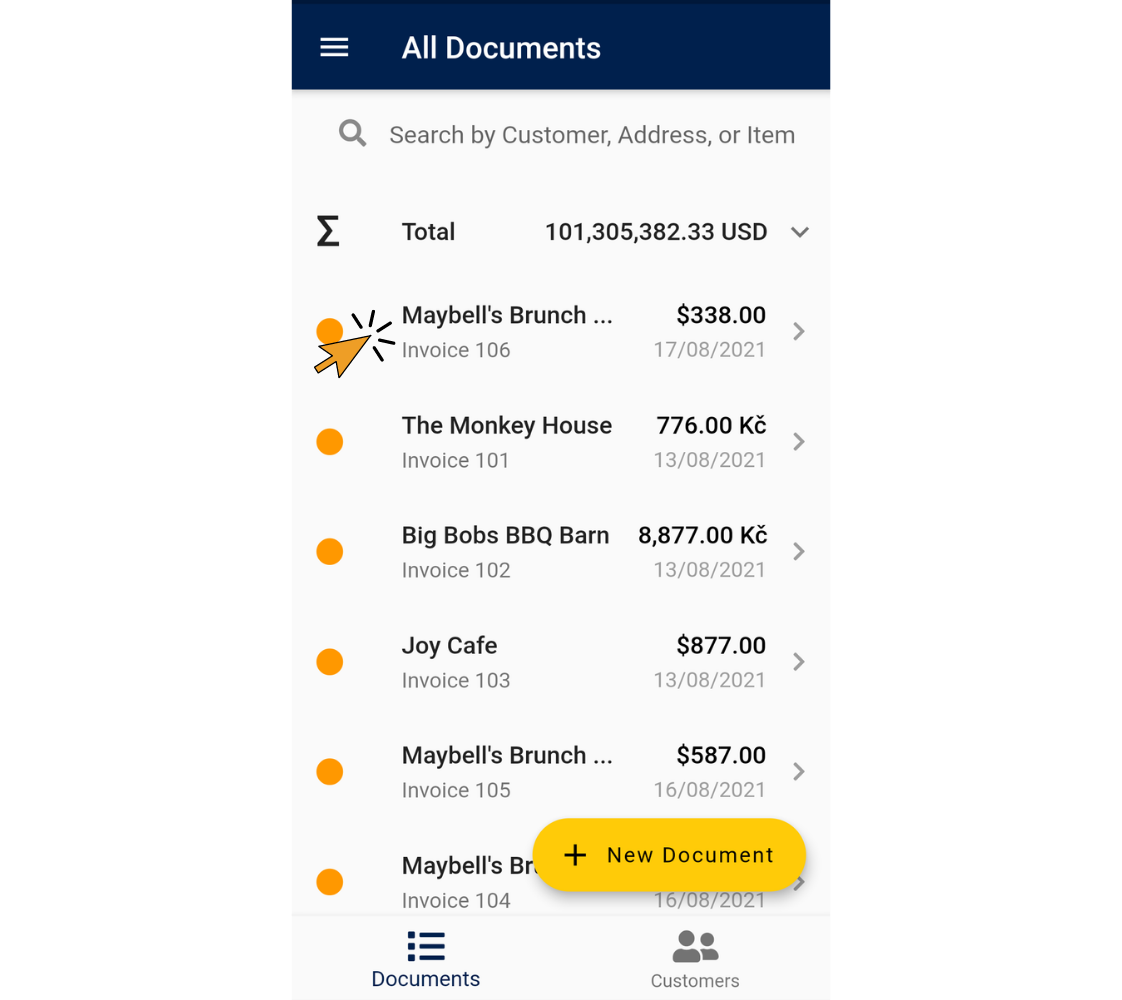

Android

1. Open the Invoice Home App.

2. Tap on an invoice in your document list, or create a new one.

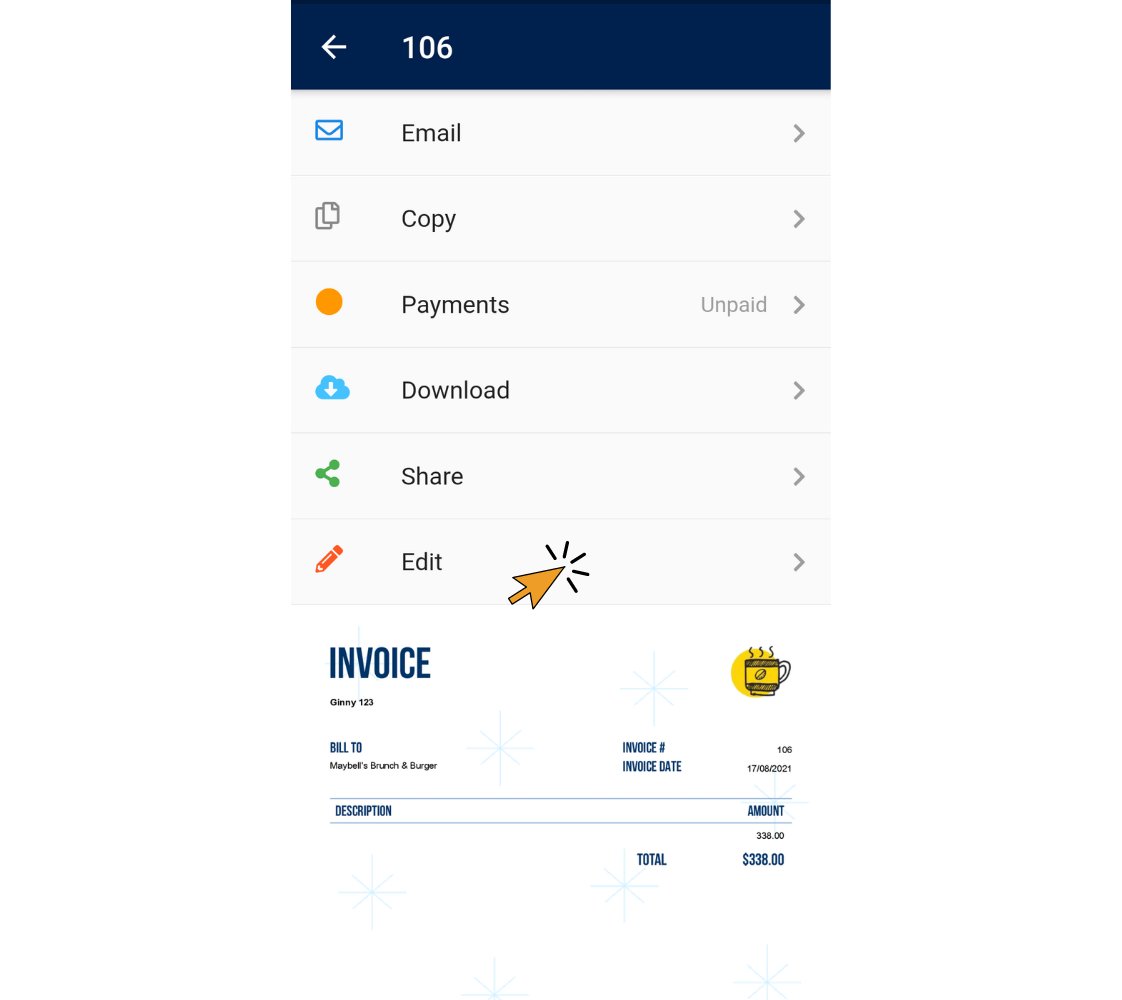

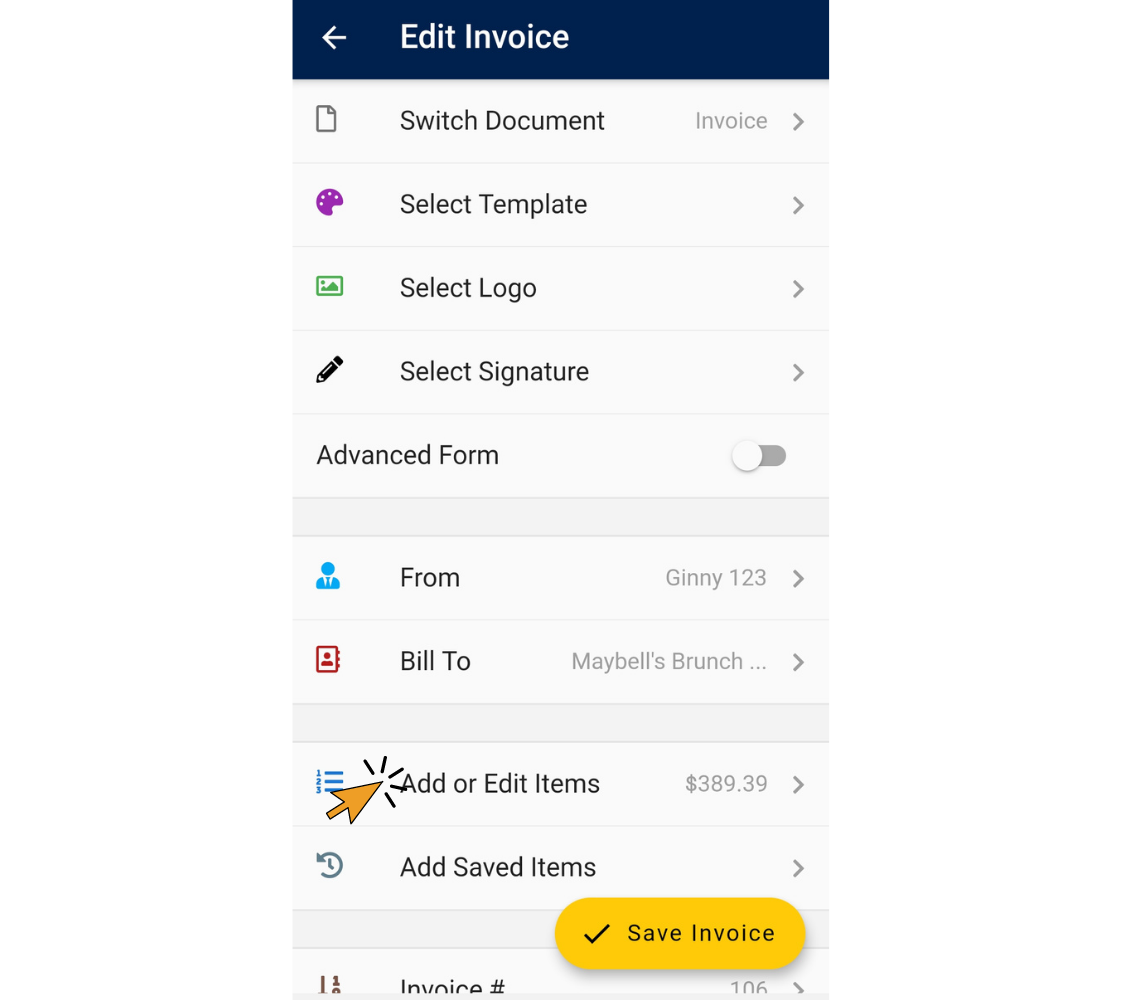

3. Tap "Edit"

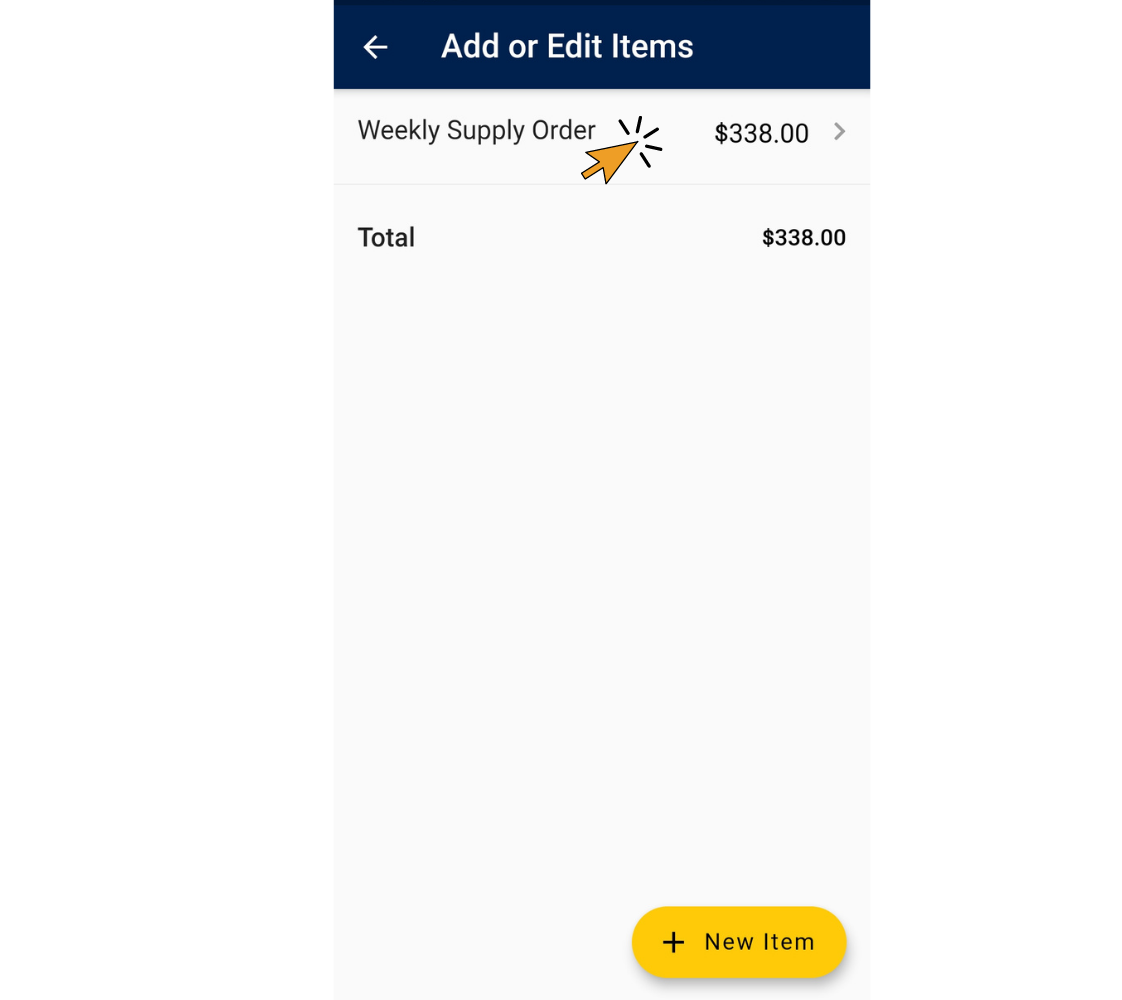

4. Tap "Add or Edit Items."

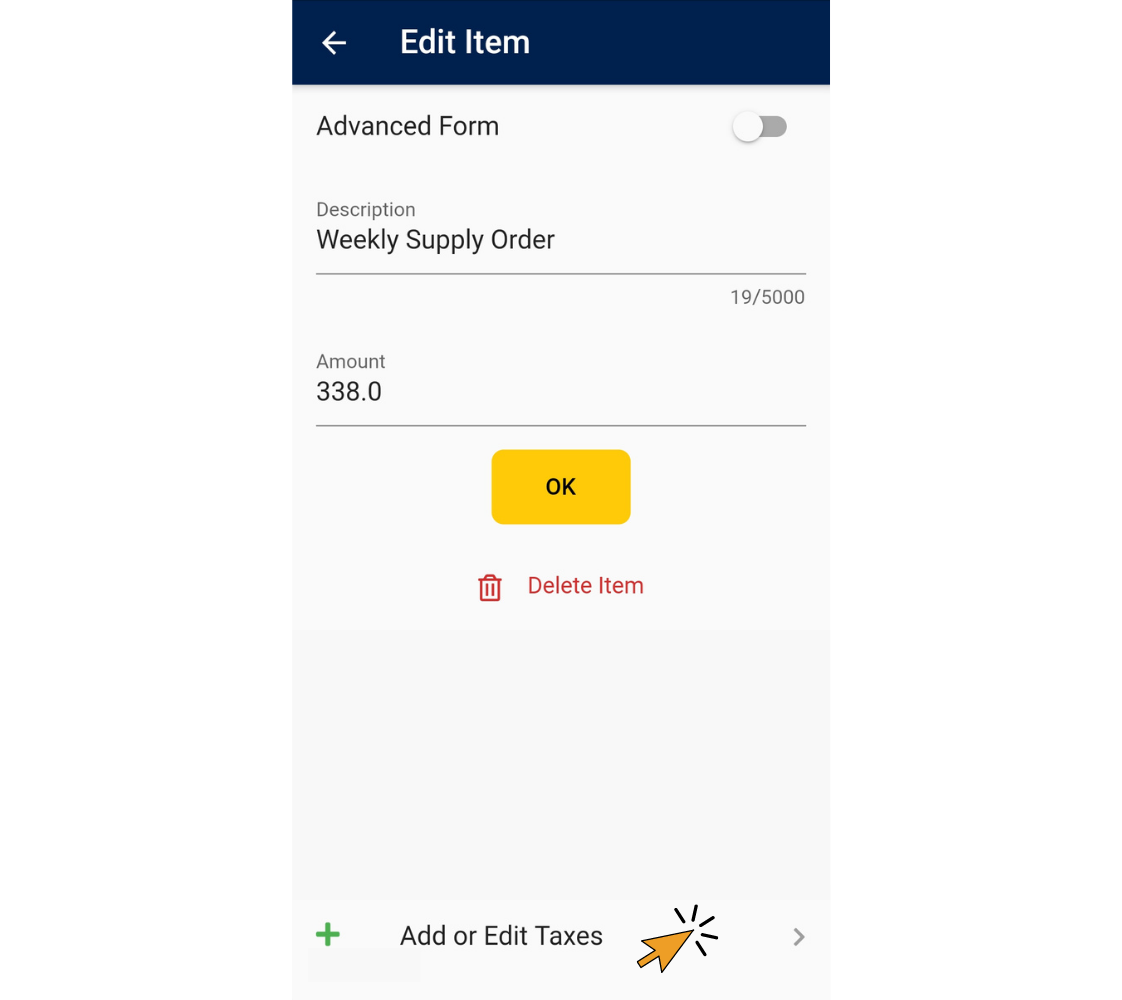

5. Tap on the item you want to add a tax to.

6. Tap "Add or Edit Taxes".

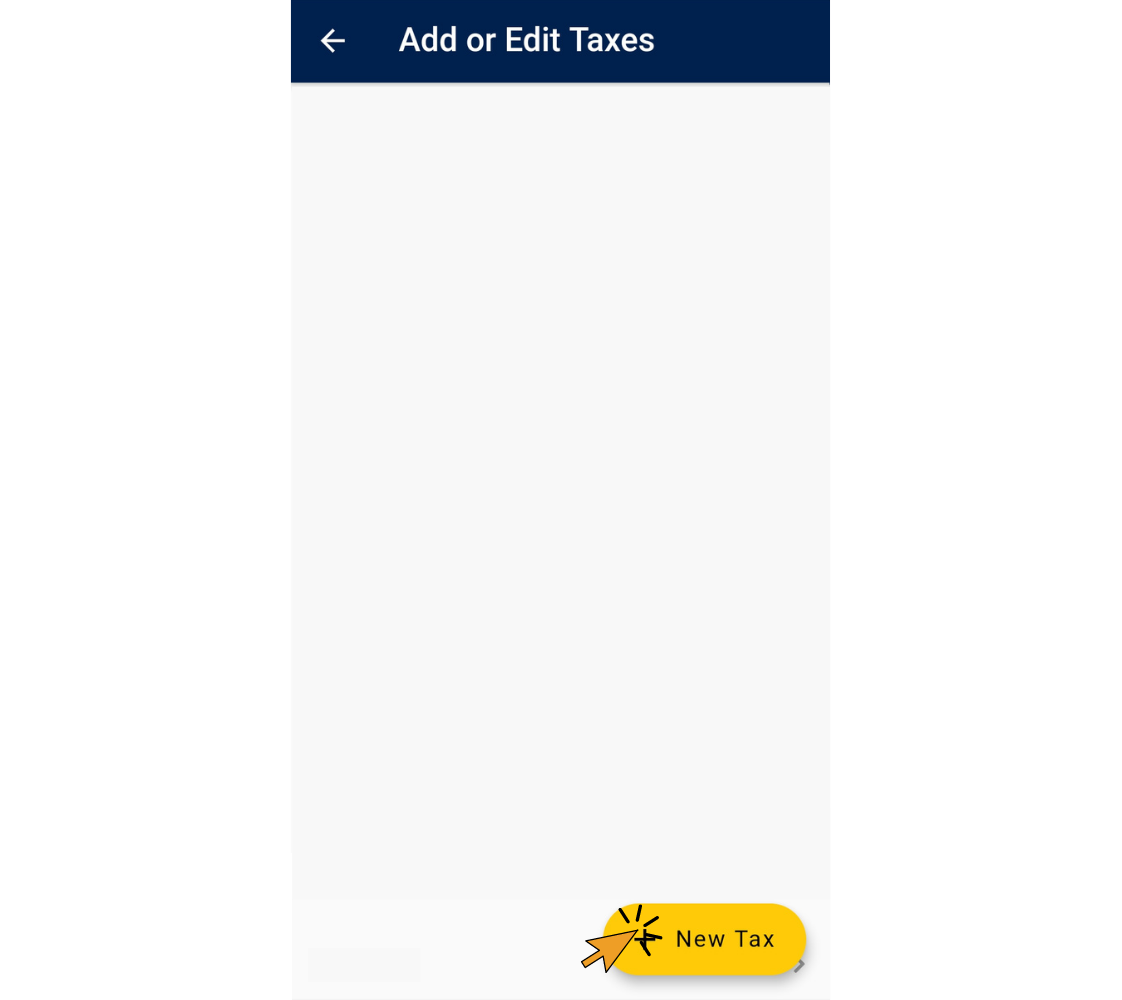

7. Tap "New Tax".

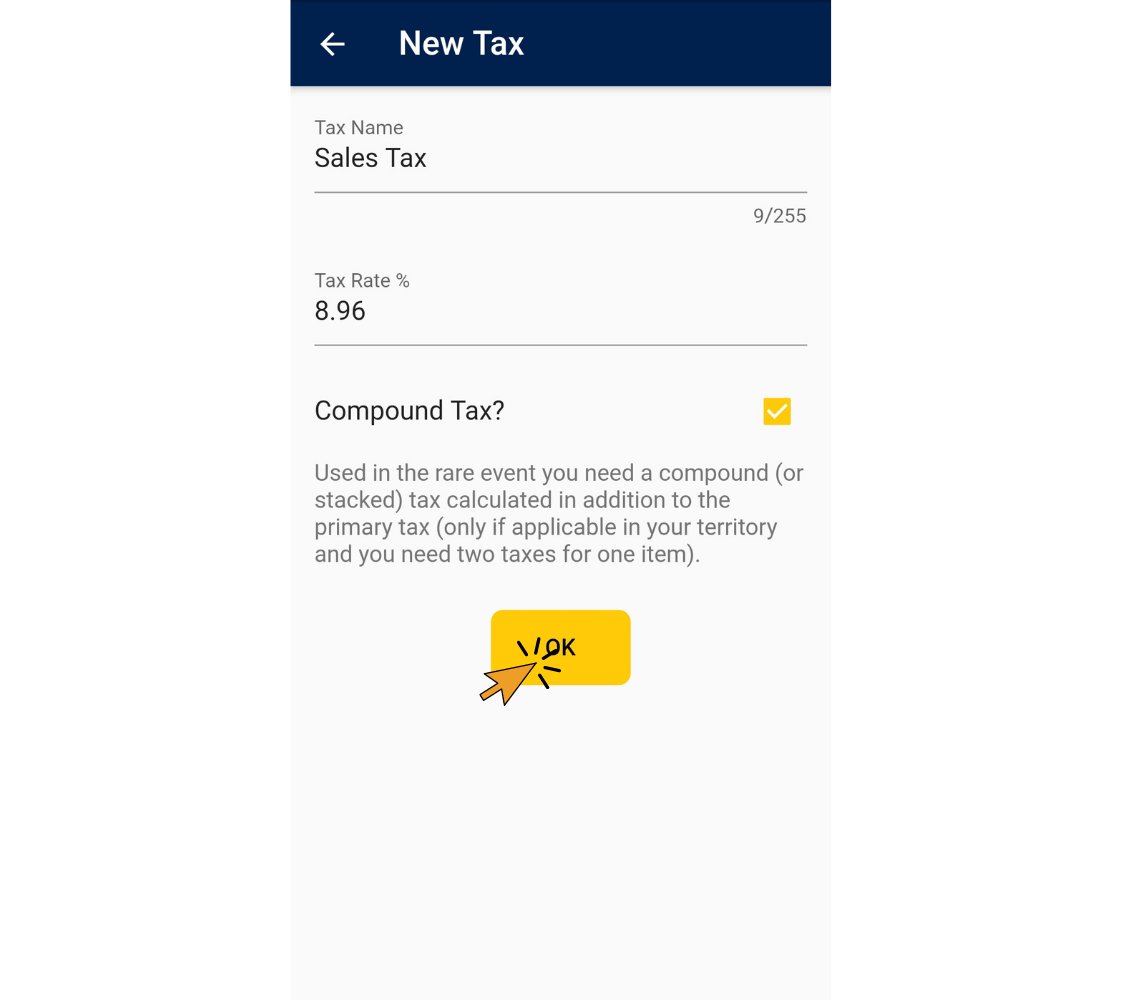

8. Fill in the Tax Name and Tax Rate % fields. Tap "OK".

Note: Repeat this process for every item you want to apply the first tax to before adding the second tax.

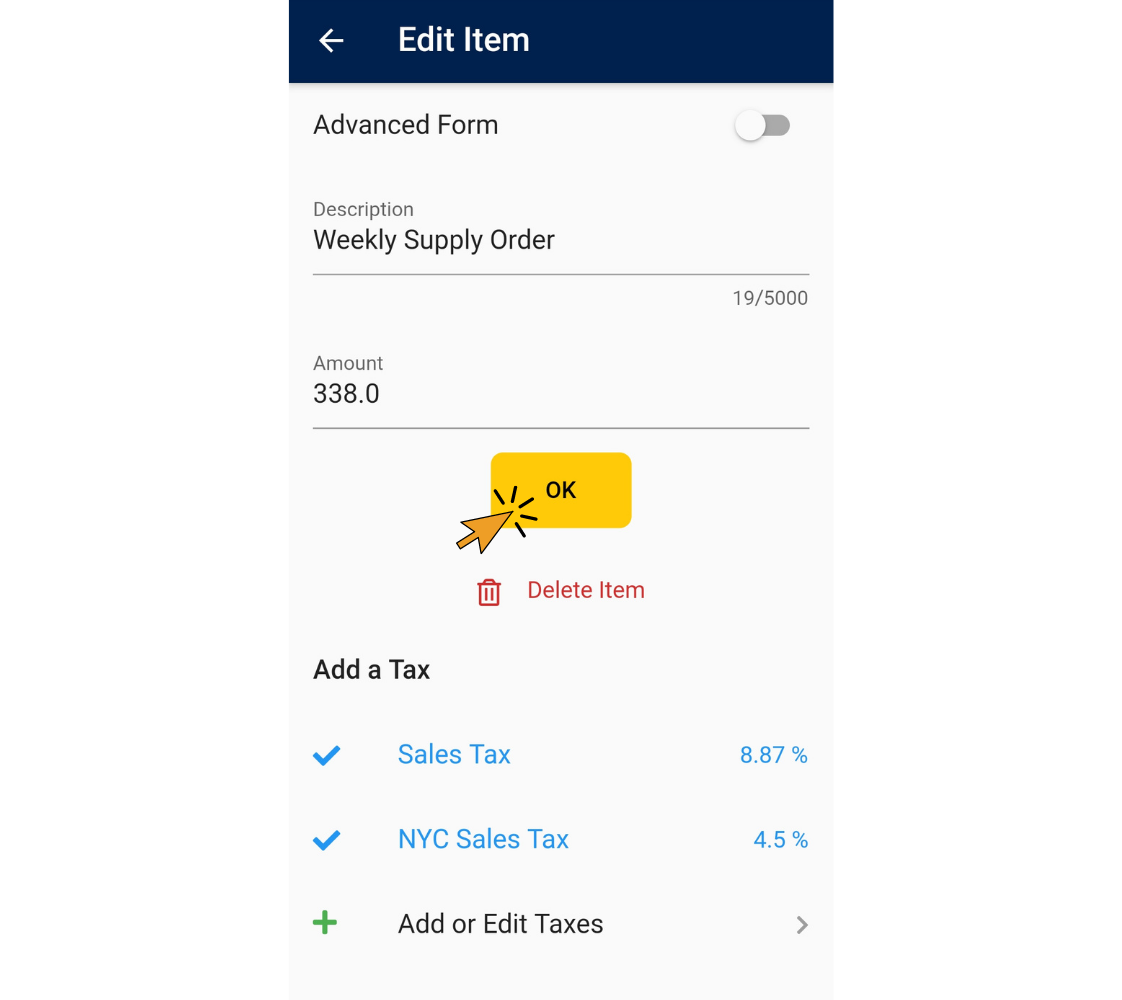

9. Create another new tax as instructed above, or from the list of taxes you previously created, tap on the tax so two taxes are checked. Tap "OK".

Note: If you need the second tax to be compounded, click the box next to "Compound Tax" when you create a new tax. A compound tax is only used in a few regions in the world, and it's calculated in addition to the primary tax.

Congrats! You’re done! Plus, the taxes you added are all saved so you can use them in the future.

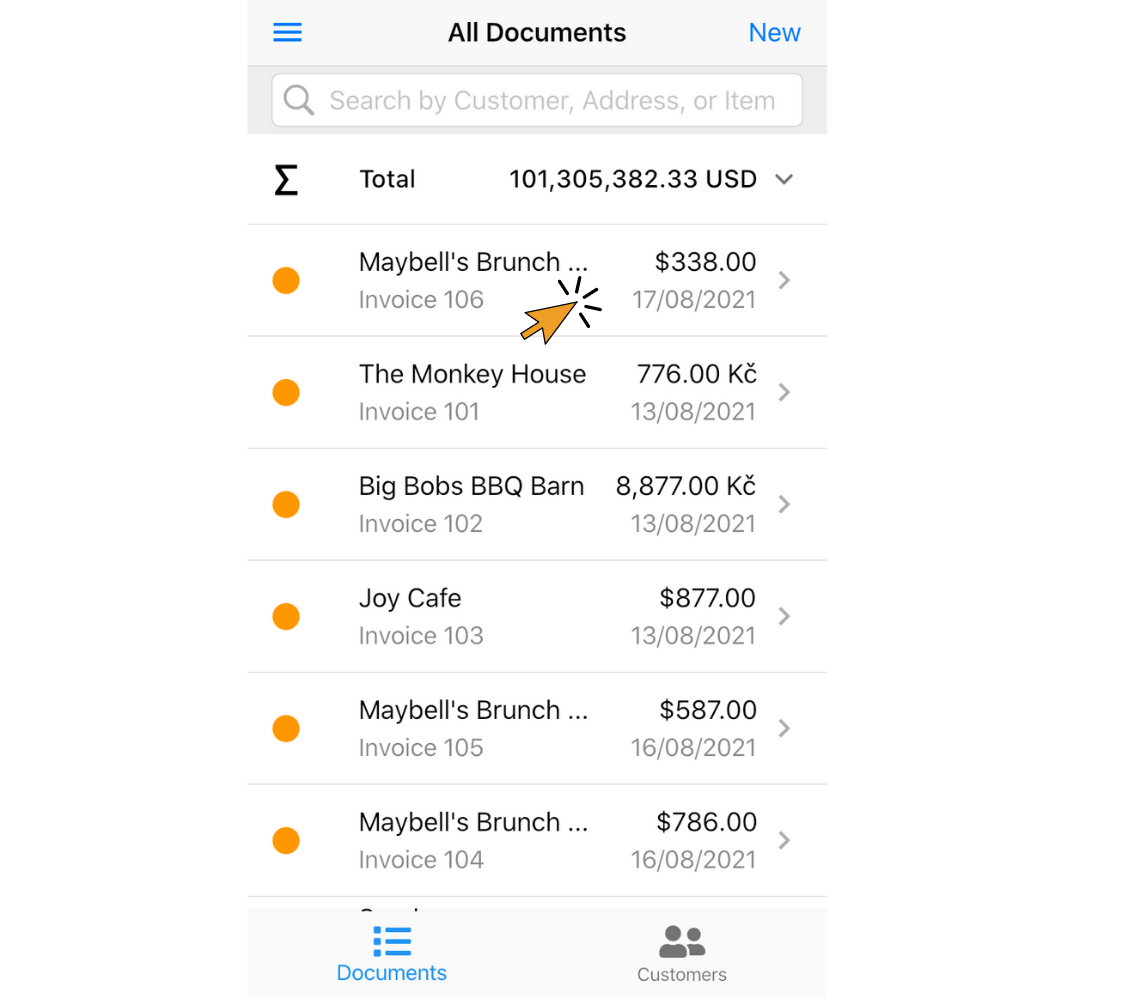

Invoice Home App - iOS

1. Open the Invoice Home App.

2. Tap on an invoice in your document list, or create a new one.

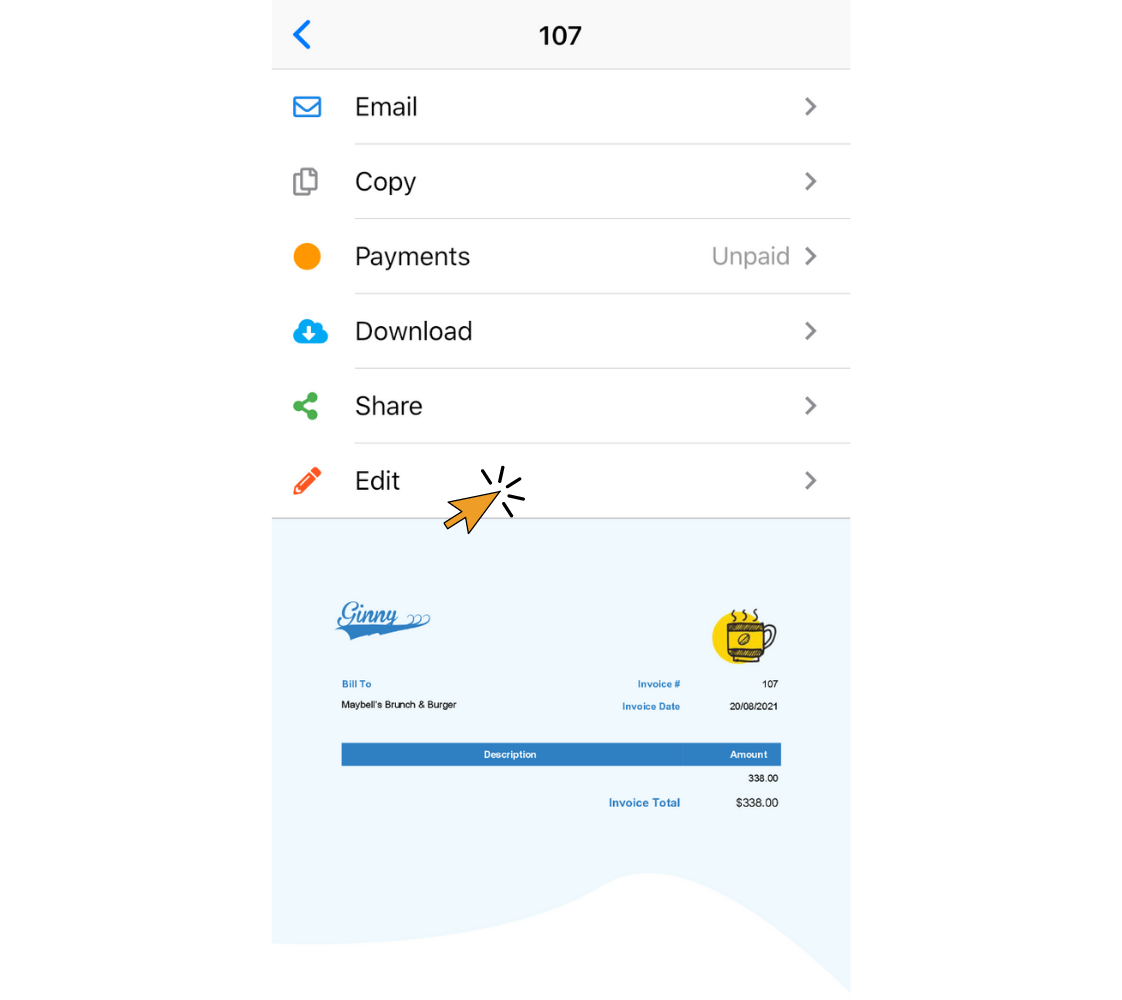

3. Tap "Edit".

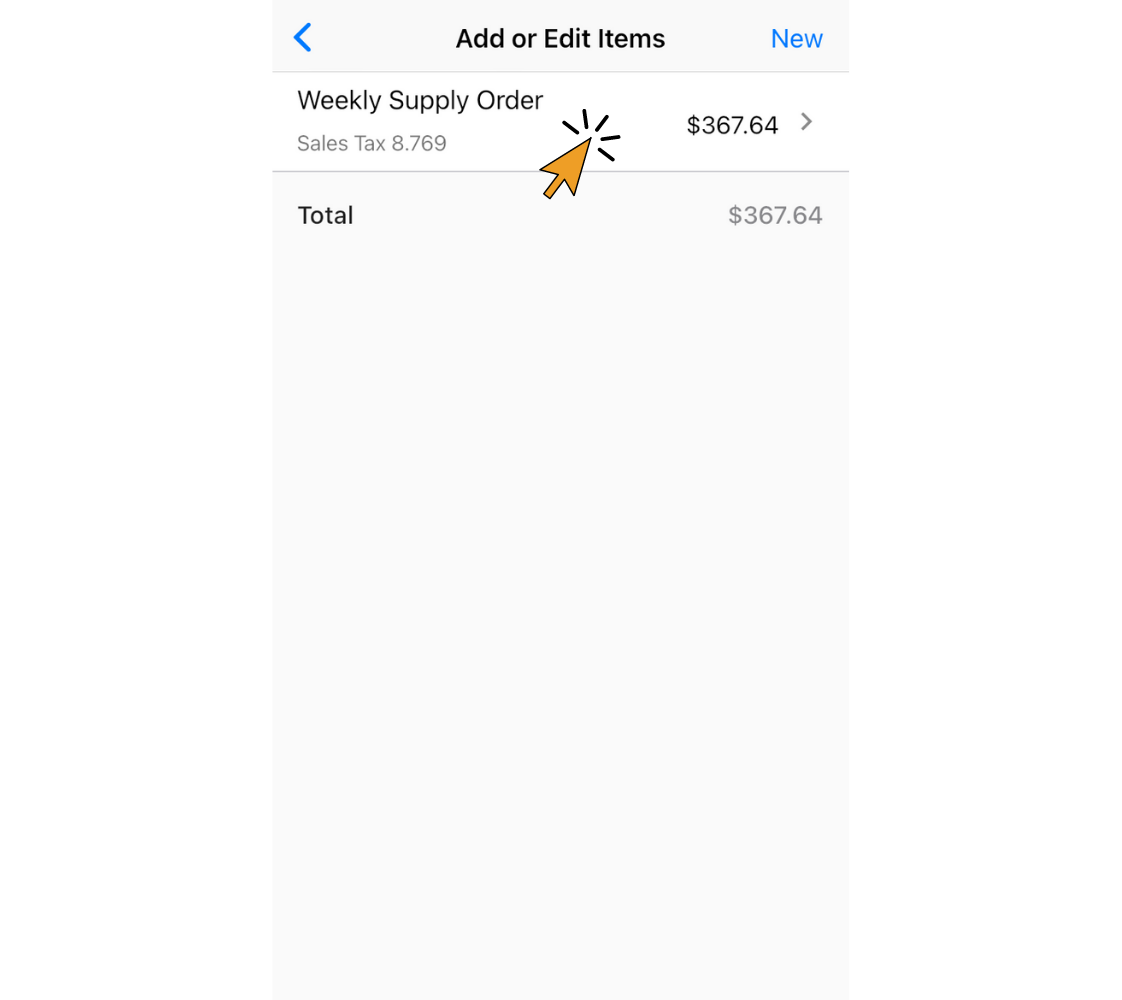

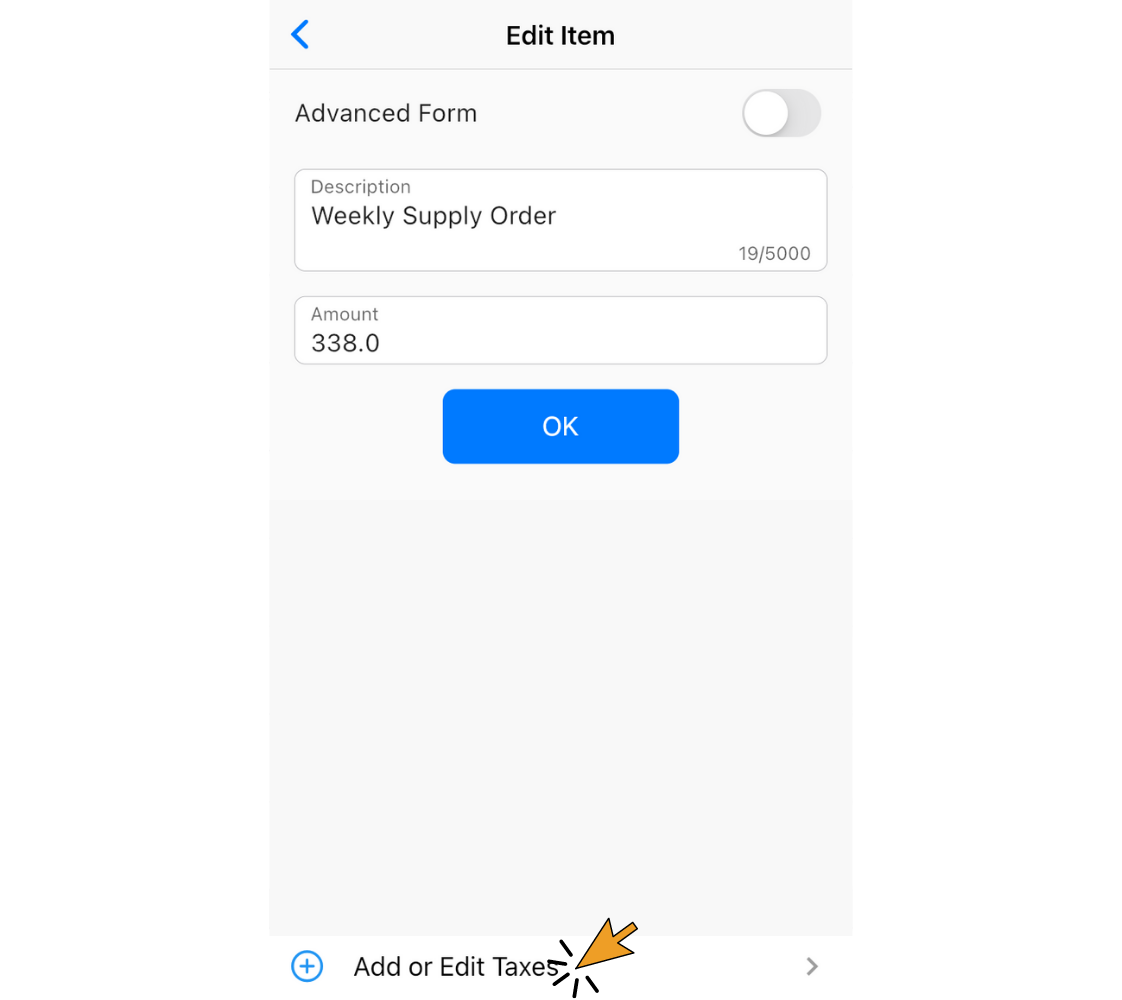

4. Tap "Add or Edit Taxes"

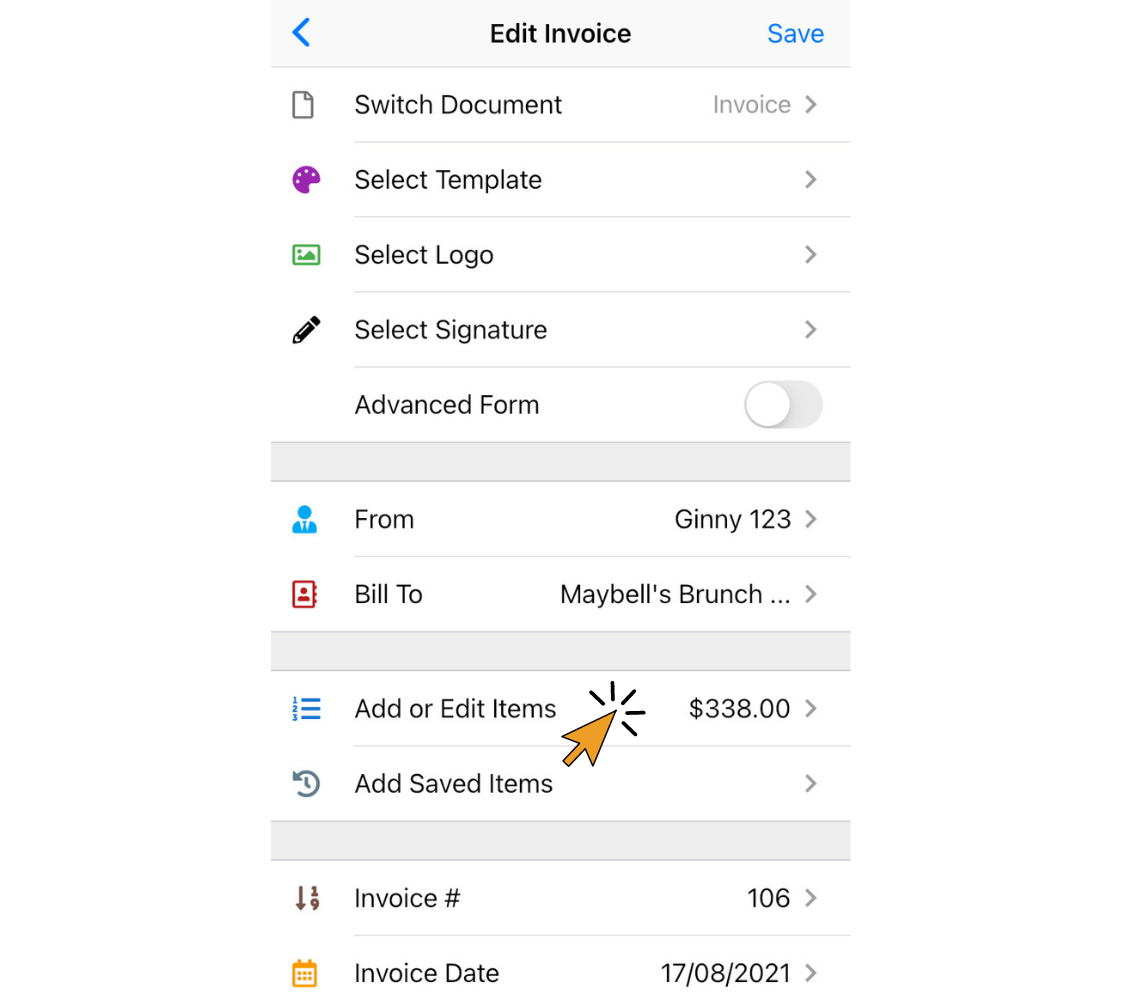

5. Tap on the item you want to add a tax to.

6. Tap "Add or Edit Taxes"

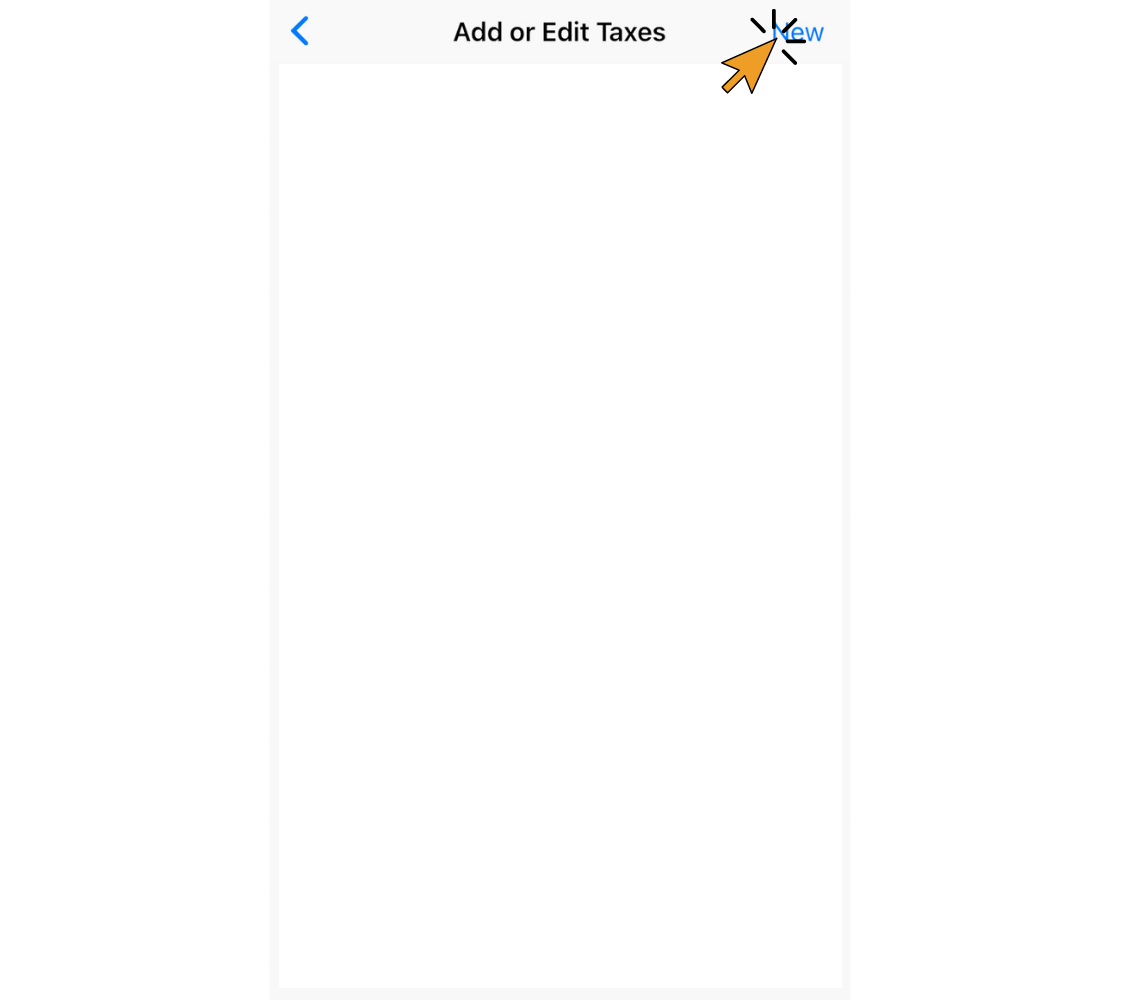

7. Tap "New Tax".

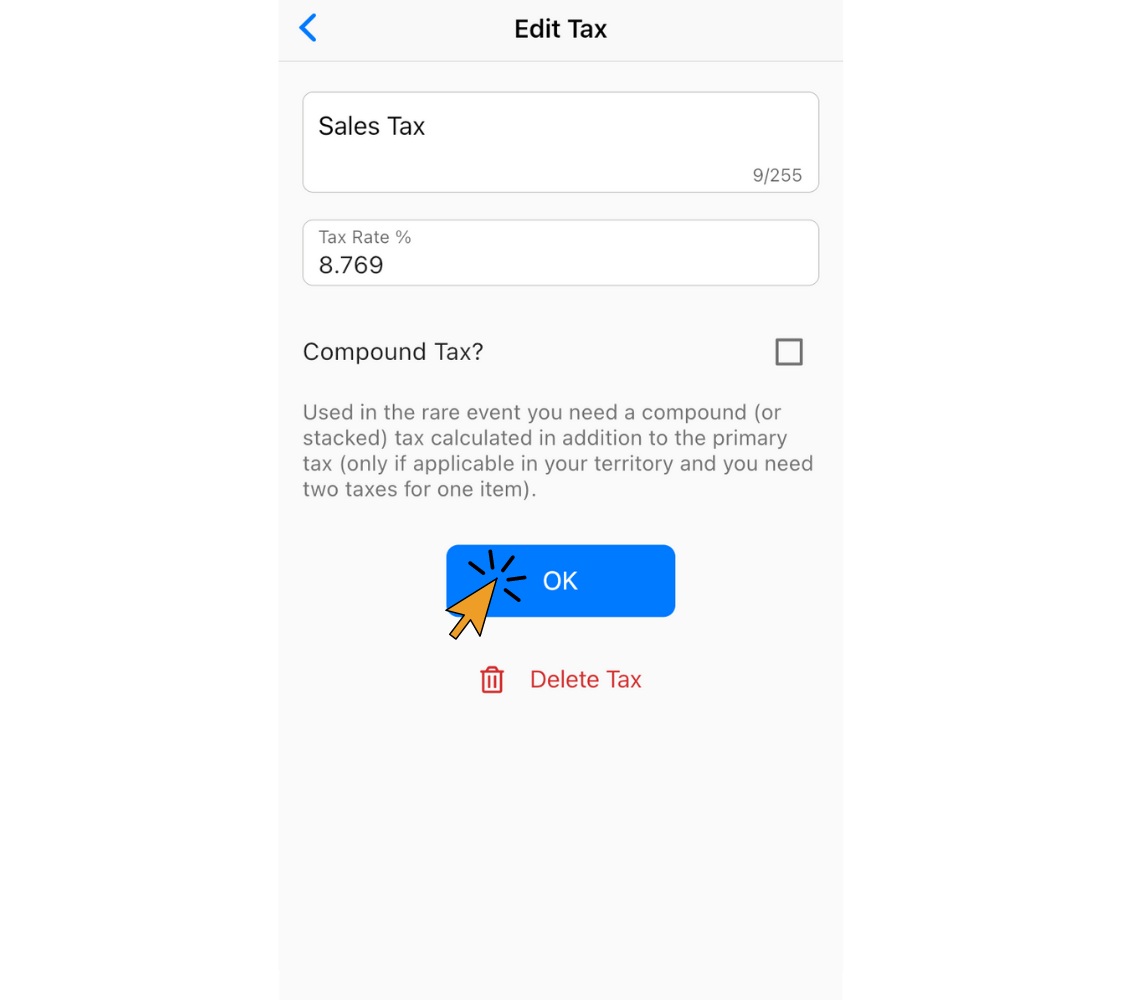

8. Fill in the Tax Name and Tax Rate % fields. Tap "OK".

Note: Repeat this process for every item you want to apply the first tax to before adding the second tax.

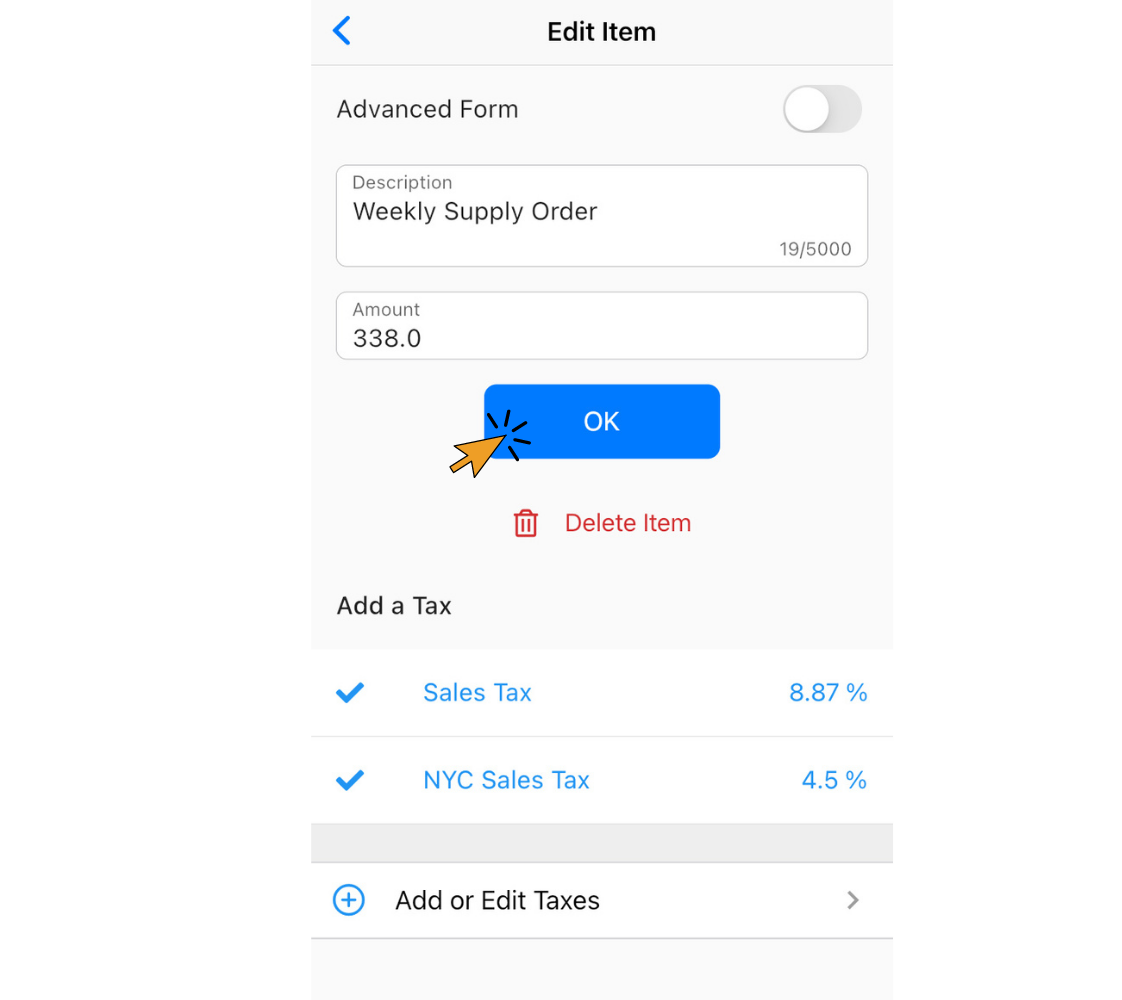

9. Create another new tax as instructed above, or from the list of taxes you previously created, tap on the tax so two taxes are checked. Tap "OK"

Note: If you need the second tax to be compounded, click the box next to "Compound Tax" when you create a new tax. A compound tax is only used in a few regions in the world, and it's calculated in addition to the primary tax.

Congrats! You’re done! Plus, the taxes you added are all saved so you can use them in the future.

Find out more about Invoice Home’s features and functions!

Thank you for using Invoice Home!