What Is An Invoice? The 4 Most Important Elements.

©contrastwerkstatt /Adobe Stock

So you’re wondering exactly what is an Invoice? The term “invoice” gets thrown around a lot, but can be confusing at first to understand.

At its core, an invoice is the document that marks a transaction between a buyer and seller for goods or services sold. As a seller, an invoice is the document that shows you have sold something, and ultimately gets you paid. As a buyer, an invoice is the bill for what you have bought.

Although somewhat intimidating, they are a necessity and important to get right. And hey, no promises, but they can be kind of fun, at the very least when you get paid after.

Table of Contents

- What an Invoice Looks Like

- Types of Invoices

- Invoice vs Bill vs Receipt - Key Differences and When to Use Each

- How to Make an Invoice

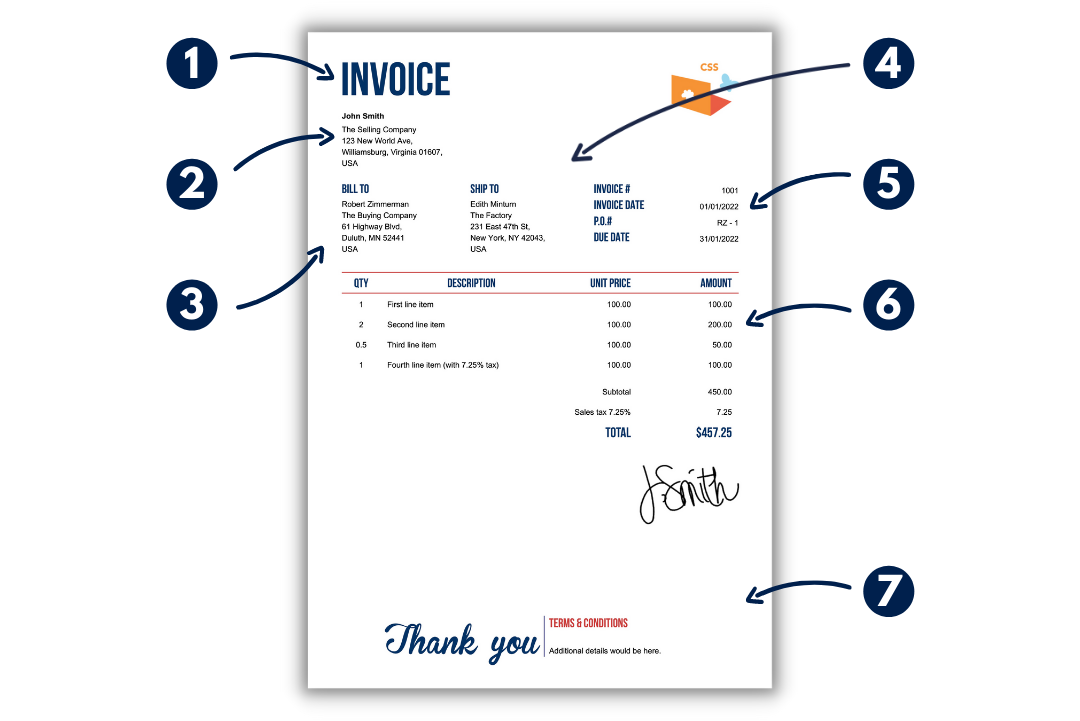

What an Invoice Looks Like

An invoice really can look however you want. But at the end of the day they're a tool to get you paid, so making sure you get the relevant information across is most important.

What Goes in an Invoice?

Generally, in terms of the content in an invoice, you're going to have two main sections.

The first, with the contact information of the parties and the payment details. Then a second, with a list of the goods and services. Oftentimes, the contact information will be above, and the details of the items below.

Some examples of the details might include:

- Line Item Description - The name or description of what you are selling.

- Quantity Sold - How much you are selling.

- Unit Price or Hourly Rate - The unit price for a physical good or an hourly rate for a service. EX: $10 per box of apples or a cashiers wage of $15 an hour.

- Total Price - This is the unit price/hourly rate multiplied by the quantity sold. If you sold 15 boxes of apples, at $10 per box, the total price would be $150.

- Any Taxes - Any applicable taxes added which are calculated per line item.

One good thing about an invoice is that they are totally customizable. If you charge by the day, hour, or job, you can specify whichever one fits you best.

Invoices are there to make your life easier. So you don’t have to track down old receipts or bank statements when tax season rolls around.

When you organize them properly, say by a systematic invoice number, you can quickly find the transaction you’re looking for.

Organizational Information

Other than the contact information and item details, you will also find an organizational section.

This can include any or all of the following:

- The invoice number - A unique identifier created by the seller. One common format is Customer Initials_number. EX: JS_1 (for John Smith’s first invoice)

- Invoice date - The date the invoice was sent.

- Due dates - When the invoice should be paid by.

- Terms and conditions - This also might be called details or notes related to the purchase. You can put whatever you have agreed to here. Oftentimes people will put something like “Invoice due in 15/30/60 days”.

- P.O. number - These can be a little complicated and are explained below.

Additionally, you can have a custom signature or brand logo included, or pick from any number of invoice templates to give your invoice the right feel for your brand.

This is where they can become a little more fun, but no promises.

P.O. #, aka Purchase Order Number

Other than an invoice number, the next organizational tool is the P.O. #, or the Purchase Order number.

They are primarily used to pair a purchase order document with an invoice, but they can also be used to separate a big shipment out, or to split one transaction over a long period of time.

Example: Say you confirm the sale of 500 apples to someone to be delivered each month for the next 5 months in batches of 100. The first month, you would ship 100 apples to them, and receive payment for those 100 apples. You would then do the same the second, third, fourth and fifth months.

What would happen is, each month you would need a separate invoice to record the transactions for each time you ship 100 apples. The issue is that all of the shipments are really part of the same transaction. This is where a Purchase Order number comes in handy.

Each invoice you send to the apple-buyers would look the same, but each would have a different P.O. number (1 - 5), yet with the same invoice number.

Typically the P.O.# will be generated by the buyer, and then given to the seller. This is so the P.O.# can be matched with the correct invoice number, which is often generated by the seller. It’s a little confusing but this is the gist:

- P.O. Number - Created by the Buyer, given to the seller.

- Invoice Number - Created by the Seller, given to the buyer.

Invoice Layout

In summary, this is the top to bottom order of the details on a typical Invoice Home invoice.

- Invoice title

- Seller’s information.

- Buyers information.

- Shipping address (if applicable).

- Relevant organizational information.

- Transaction details.

- Additional details (terms and conditions).

The actual placement of the details, especially the contact information, can vary from place to place, but this is one of the more common layouts out there, and what we use for our templates at Invoice Home.

Types of Invoices

Ah the various types of invoices, a formidable foe in terms of proper understanding.

Fortunately what differentiates an invoice basically comes down to if there are special tax circumstances, or if a record of a sale is needed, before the actual sale takes place.

Standard Invoice: A standard invoice is the typical document used to itemize and record a transfer of goods or services.

Tax Invoice: An invoice specifically used to record the transaction of taxable goods and services.

They are often used when people or businesses want to record taxes for deduction purposes or need the date of the transaction recorded specifically for tax purposes.

Proforma Invoice: A proforma invoice is a document that represents a future sale of goods or services.

They are sent before the actual transaction has occurred, and used to measure when it will happen and what will be sold.

Typically a buyer requests a proforma invoice from a seller before making a payment to be delivered in the future.

Example: Before paying for the advertisements, the restaurant requested a proforma invoice from the radio station.

This type of arrangement isn't too common, but does exist.

Invoice vs Bill vs Receipt - Key Differences and When to Use Each

When you boil it down, invoices, bills and receipts all convey the same information.

There are two main differences between the three of them: Who is sending or receiving, and when they are sent or received (before or after payment has been made).

- Invoice - Invoices are typically sent, and always before payment has been made.

- Bill- A bill is typically received before payment has been made. Often when someone receives an invoice, they will enter it as a bill into their accounting system.

- Receipt - A receipt is received after payment has been made.

Bill vs Invoice

Because these items all have the same information, the terms get interchanged quite a lot and not necessarily super accurately.

Oftentimes people will receive an invoice and call it a bill, regardless of what the header of the document says.

The painting company sent John (the restaurant owner) an invoice for $500 for the first floor bathroom. The invoice details are as follows:

- $350 of labor.

- $50 of primer.

- $50 of paint.

- $50 of other materials.

- Payment due in 30 days.

John paid the invoice as soon as he got it, he then marked it under bills for the year.

Invoice vs Receipt

You would not give someone a receipt before they have finished paying for clothes at Macys.

Likewise you would not issue an invoice to a customer, after they’ve finished eating at your restaurant, considering you would be expecting payment right then.

Recap: Invoice vs Bill vs Receipt

As a final note, because these items all have the same information, the terms get interchanged quite a lot and not necessarily super accurately.

The most important thing to remember is that invoices and bills are issued before payment has been made. While a receipt is issued after. If everything were to go perfectly, you would get invoices, bills, and receipts in this order.

As we know, people don’t always issue all three, but you should never get a receipt before paying for an invoice or a bill. Likewise, you should never send a receipt before issuing an invoice or a bill.

We know this can be a little confusing, but we hope this helped explain the concept.

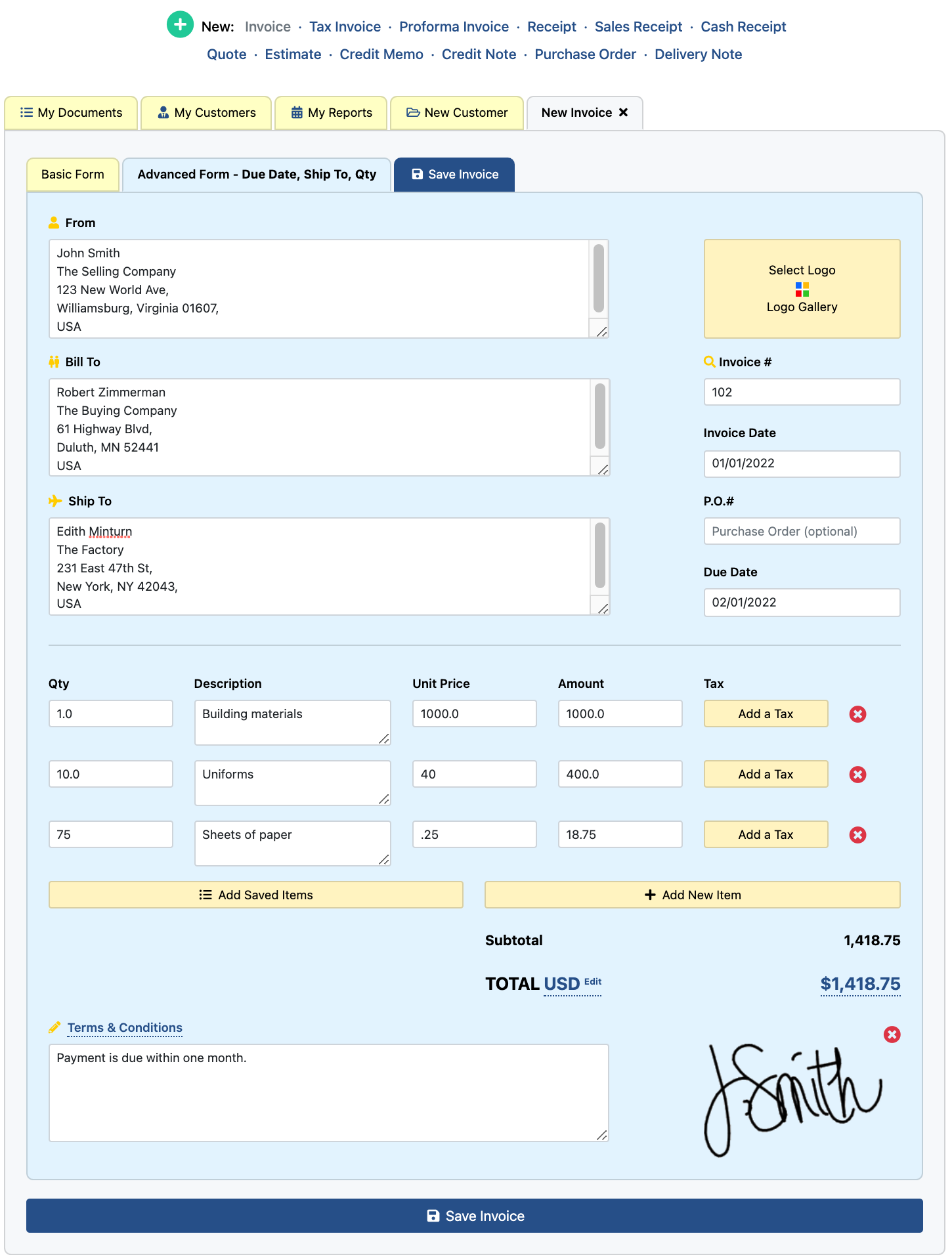

How to Make an Invoice

You can make an invoice any number of ways. Before e-invoicing came around, people would have an invoice template, and then manually enter in their data and mail or fax it to the desired recipient.

Fortunately, now that we live in an era with the internet you can send an invoice in seconds with our free invoice generator.

At Invoice Home we offer over 100 free professionally designed templates, made to simplify your invoicing process and grow your business.

You can get started now for free, and test out our features like recurring invoicing, unlimited storage, and a safe and secure network to keep your financial documents on.

Whenever you’re ready click here to get started.

Thank you for using Invoice Home!