HOW TO: Add Taxable and Non-Taxable Items on One Invoice

© Tierney /Adobe Stock

At times you may need more than just a simple invoice template, because invoicing isn’t always straightforward.

Sometimes you may need to create an invoice with taxable items. Sometimes you might need one with non-taxable items.

And sometimes...you need to include both!

Don’t worry, we’ve got you covered. With Invoice Home it’s easy.

Here’s how to add taxable and non-taxable items to the same invoice.

Desktop

1. Sign in to Invoice Home here.

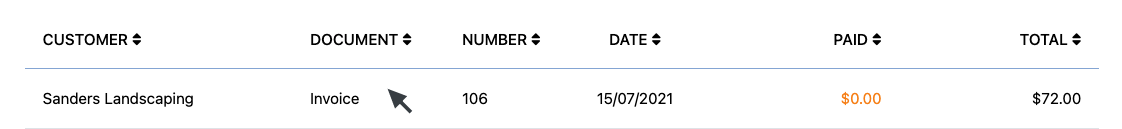

2. Click on an invoice in your document list to open it, or create a new one.

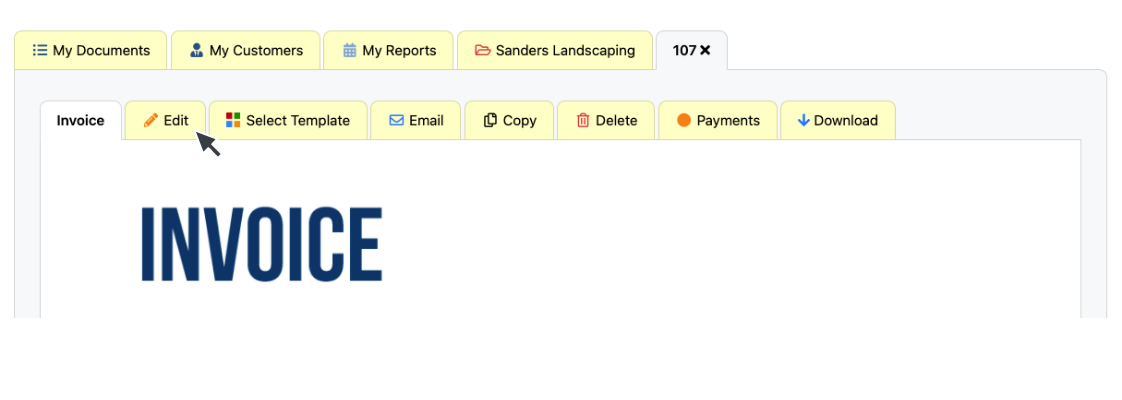

3. Click the edit tab.

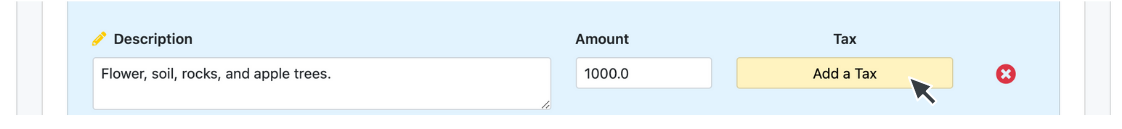

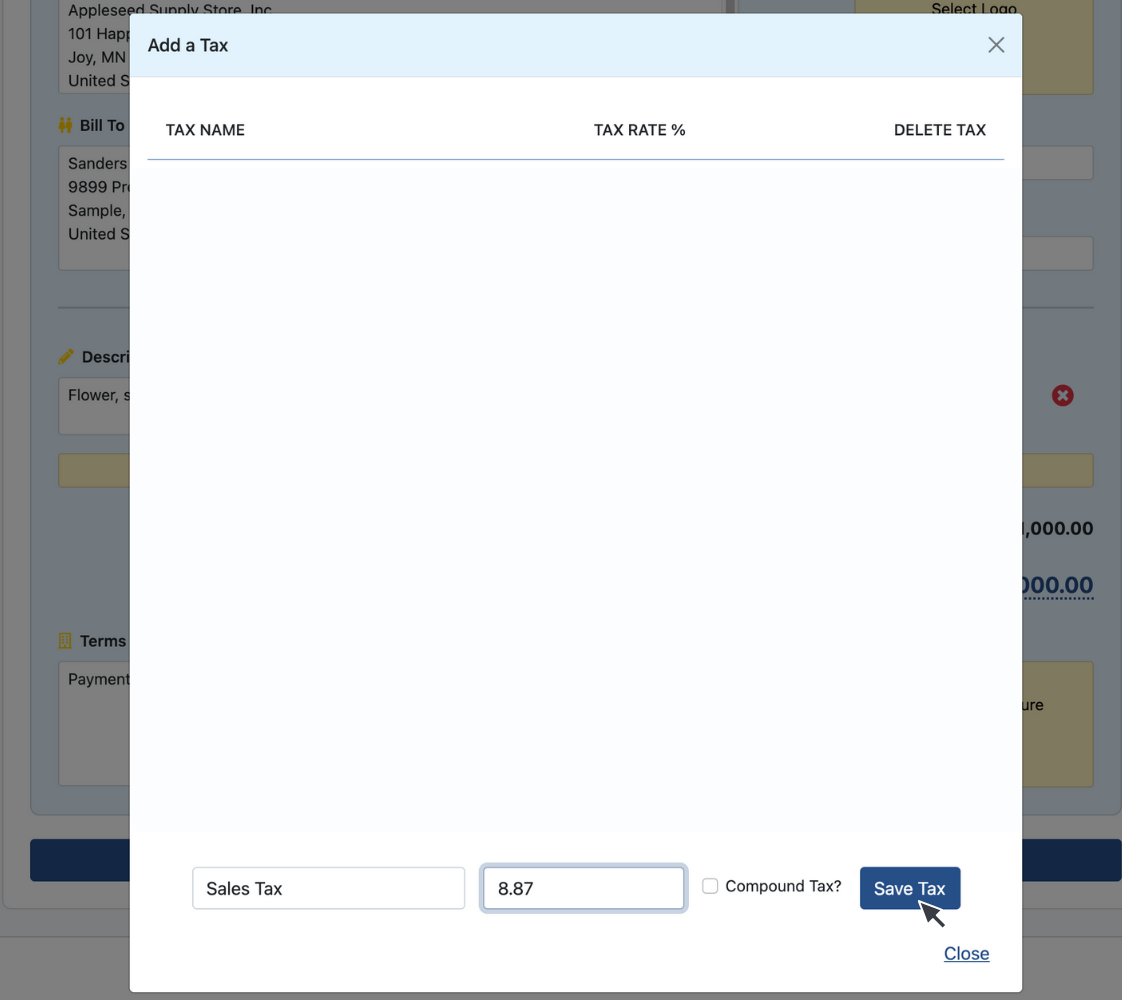

4. Click the “Add a Tax” button.

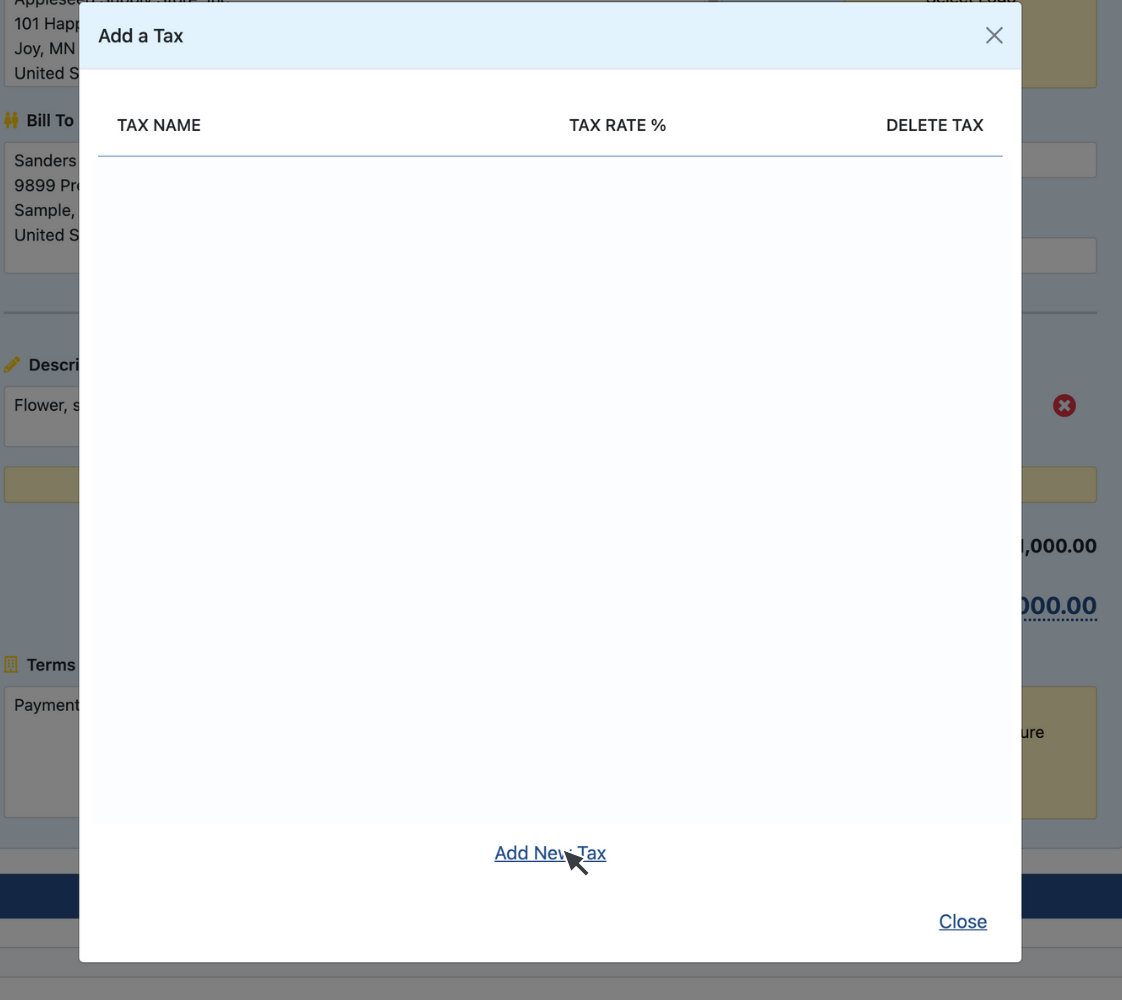

5. Click “Add New Tax”.

6. Enter the tax name, and percentage rate. Click “Save Tax”

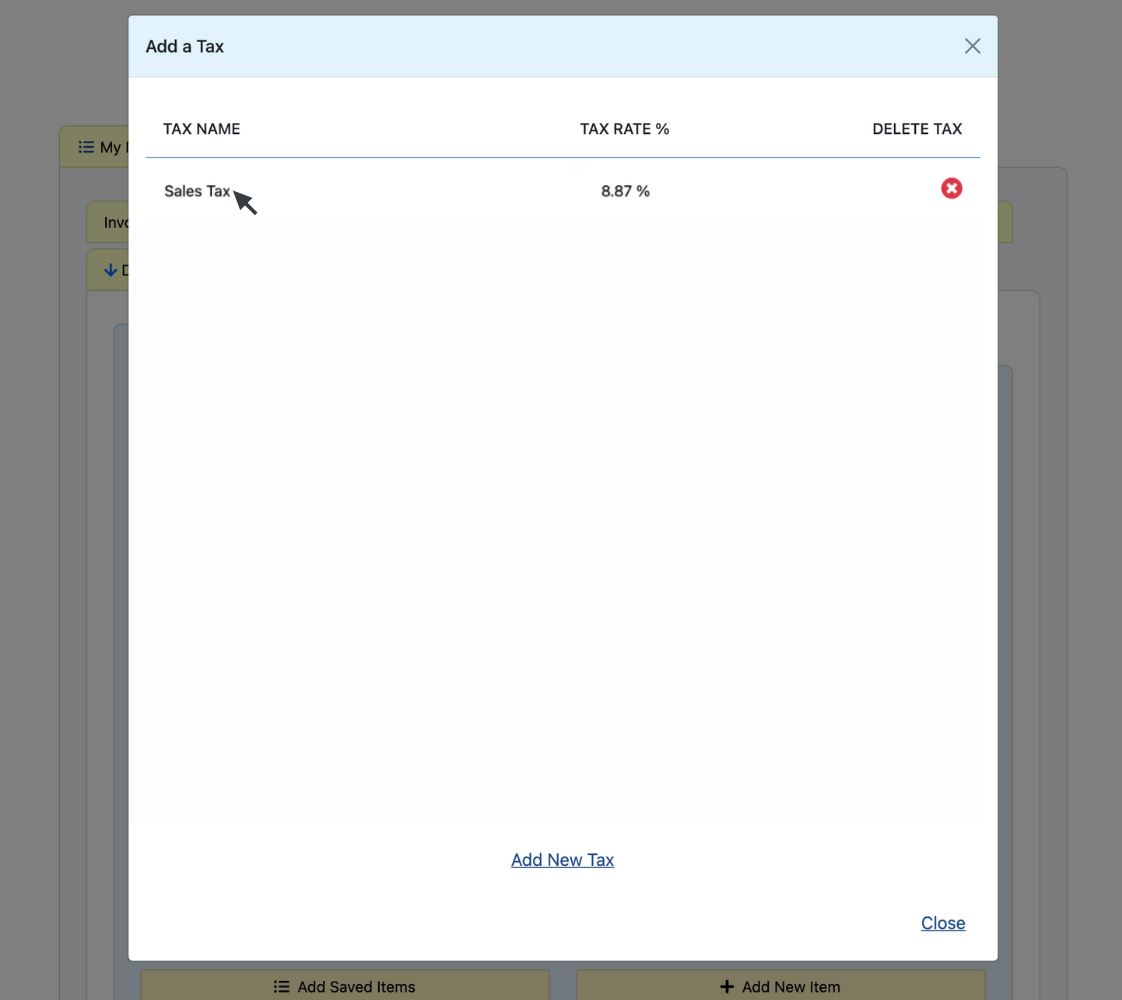

7. Click on the name of the tax you created.

That's it! You've added a taxable item to your invoice.

Here's How to Remove a Tax from an Item on Your Invoice

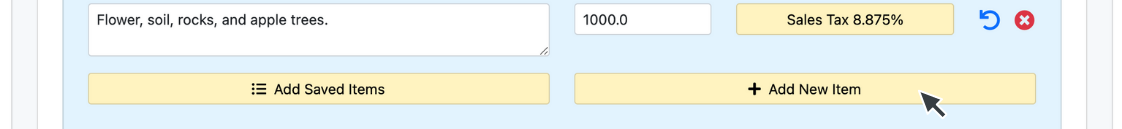

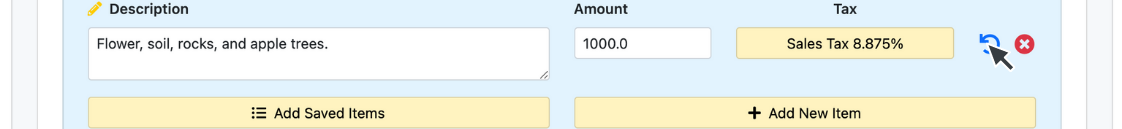

1. Click the “Add New Item” button. The tax rate will be automatically added.

2. To remove it, click the blue arrow.

That's it! Now you have taxable and non-taxable items on one invoice.

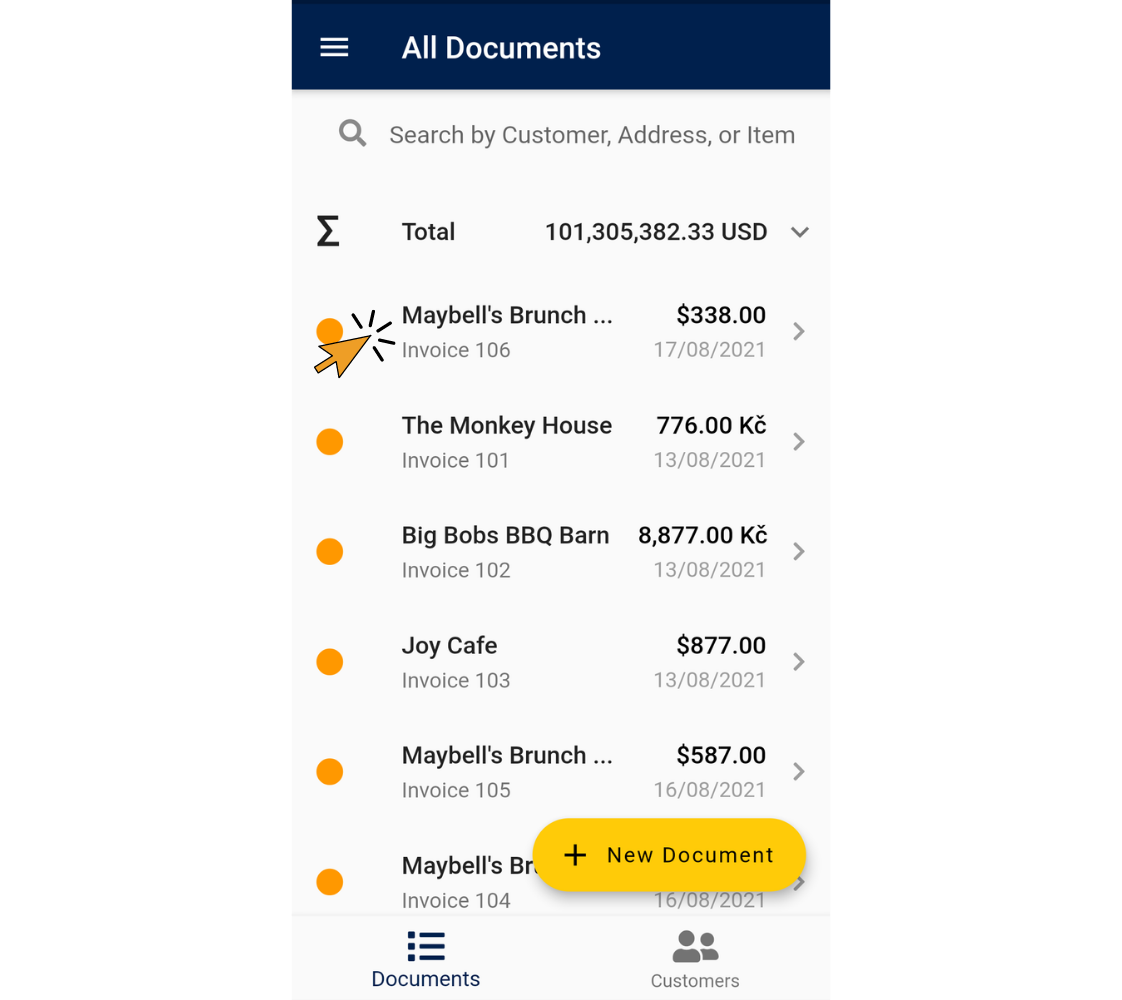

Android

1. Open the Invoice Home App.

2. Tap on an invoice in your document list to open it, or create a new one.

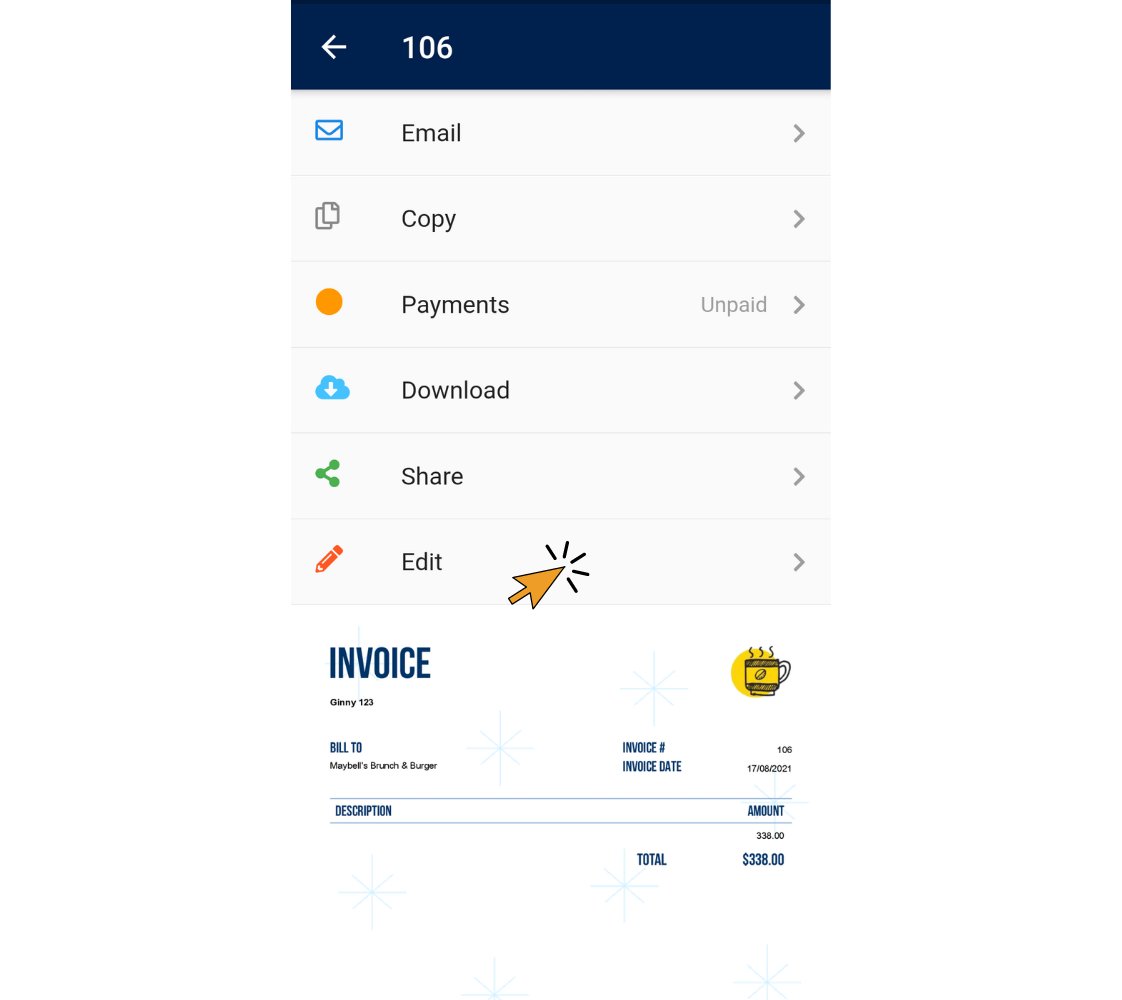

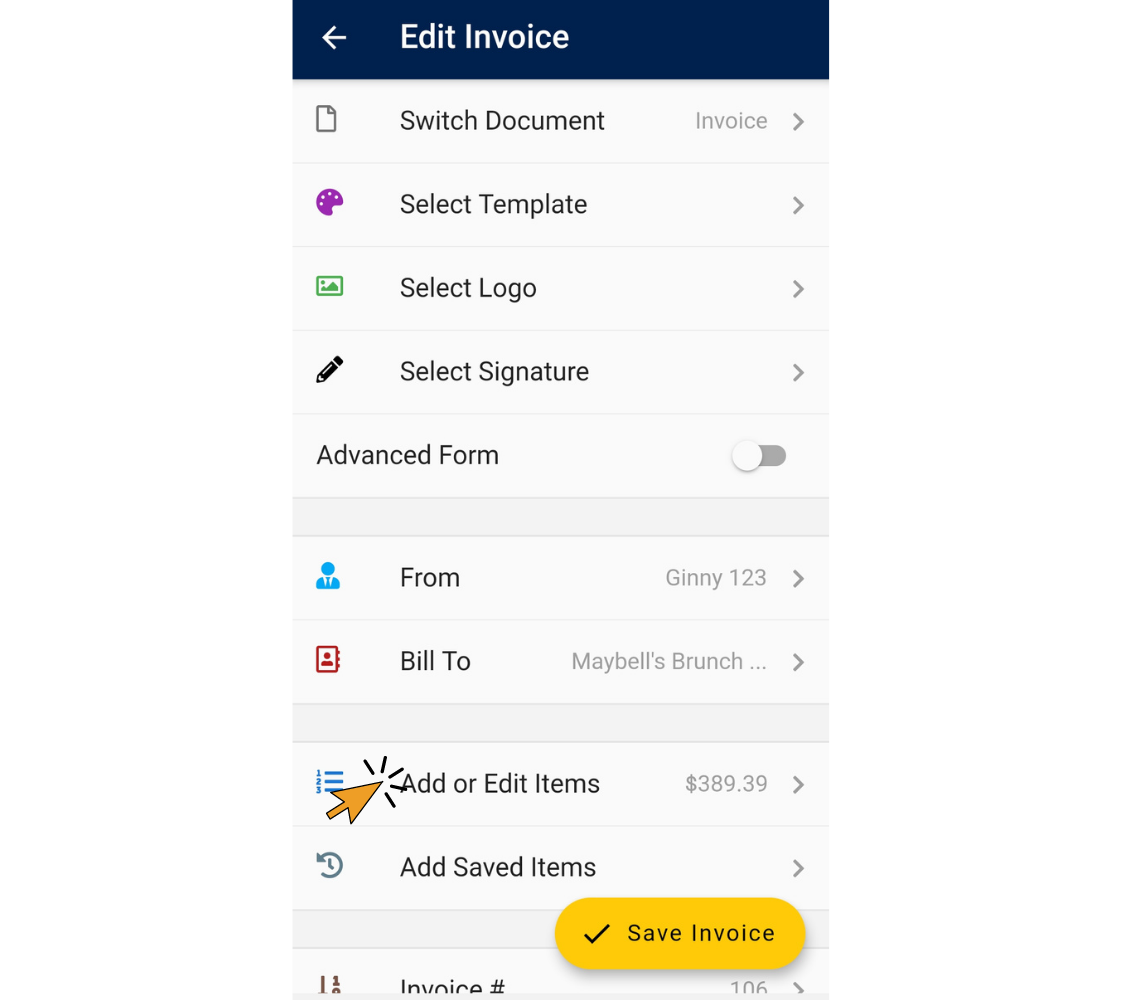

3. Tap the edit tab.

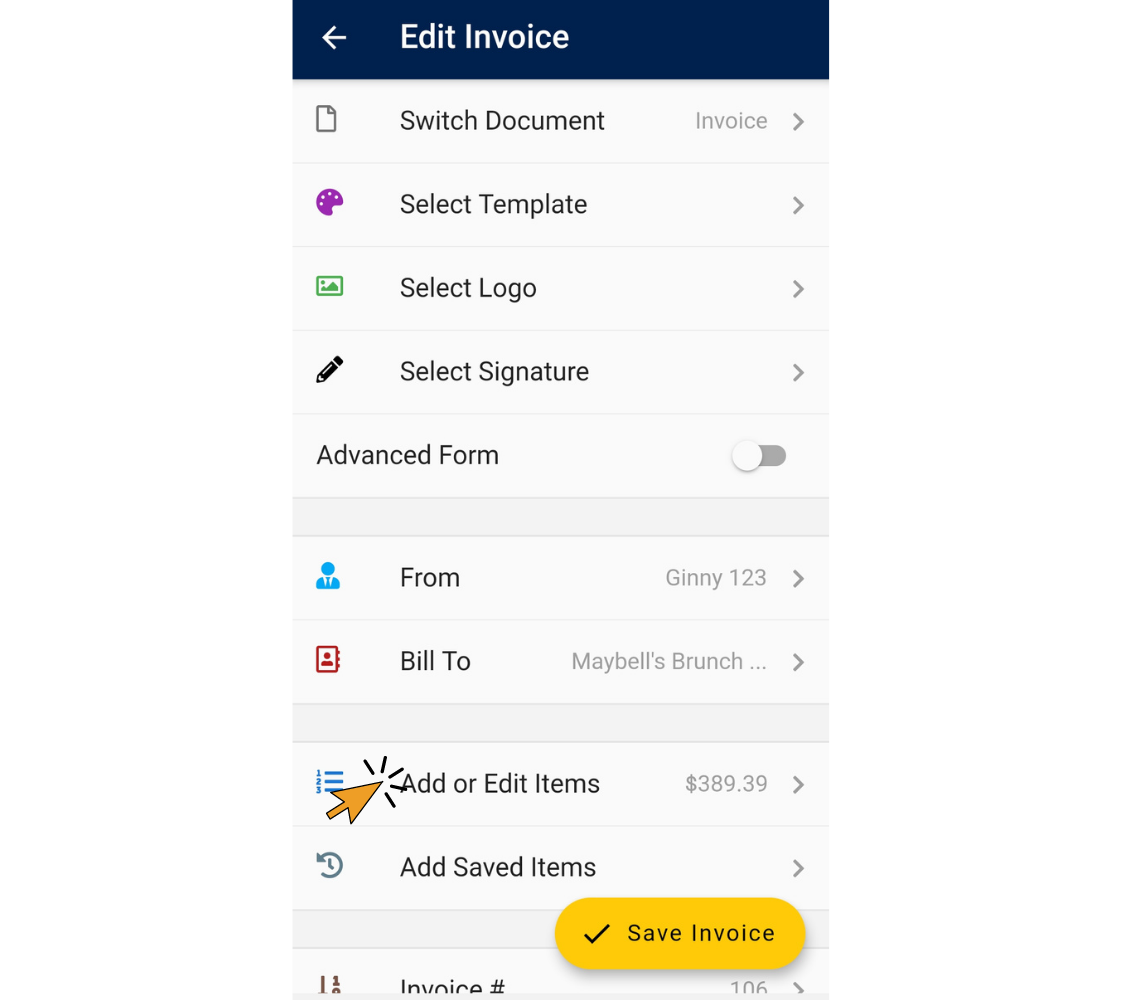

4. Tap “Add or Edit Items”.

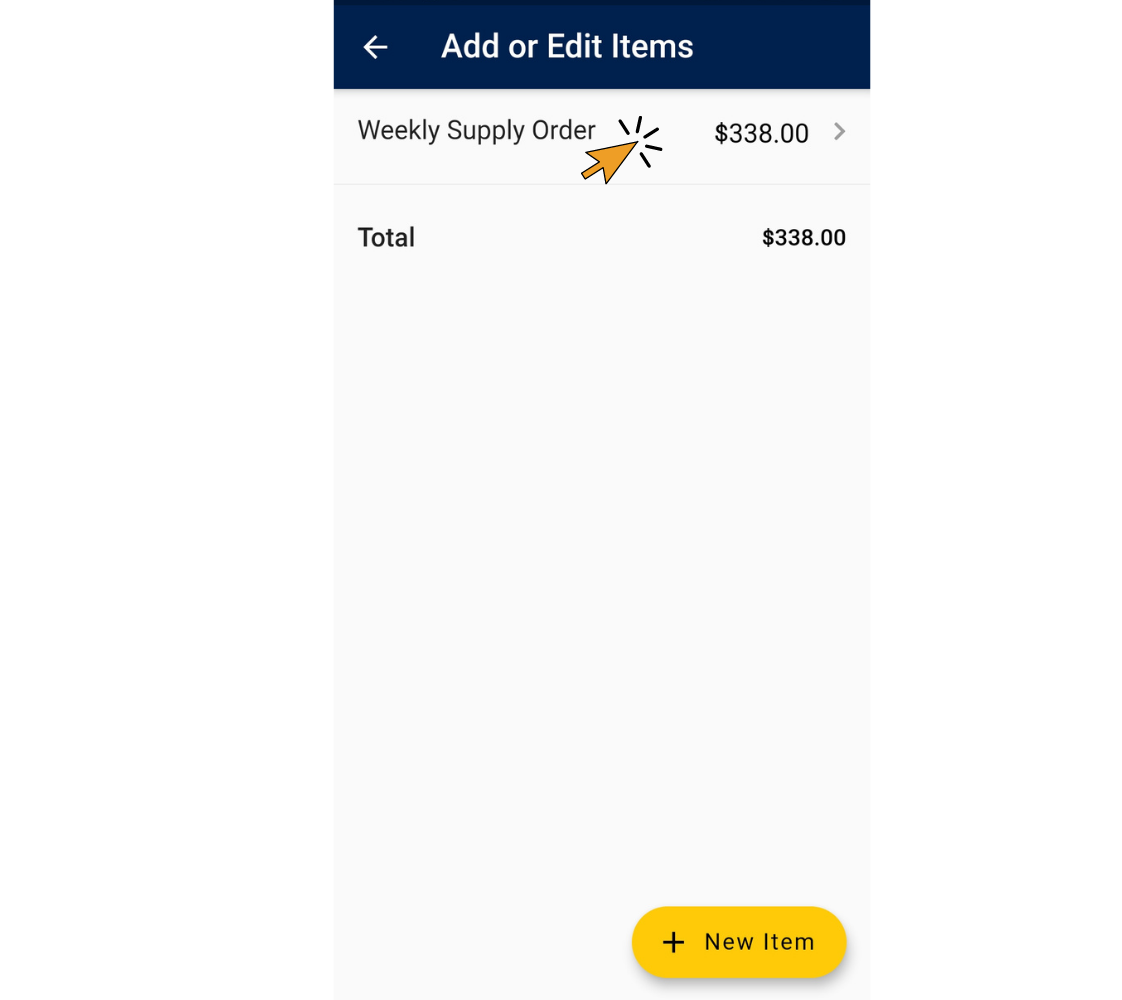

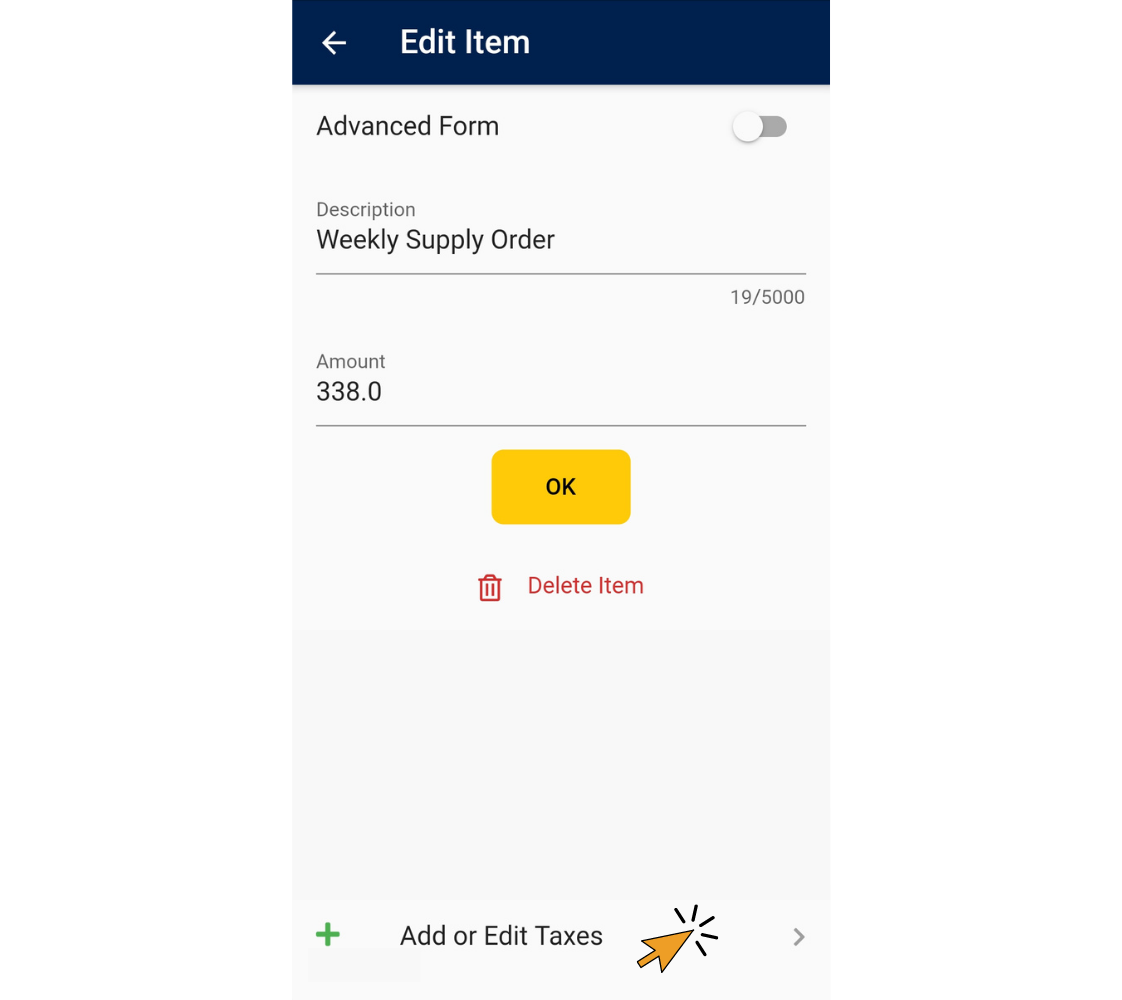

5. Tap on the name of the item.

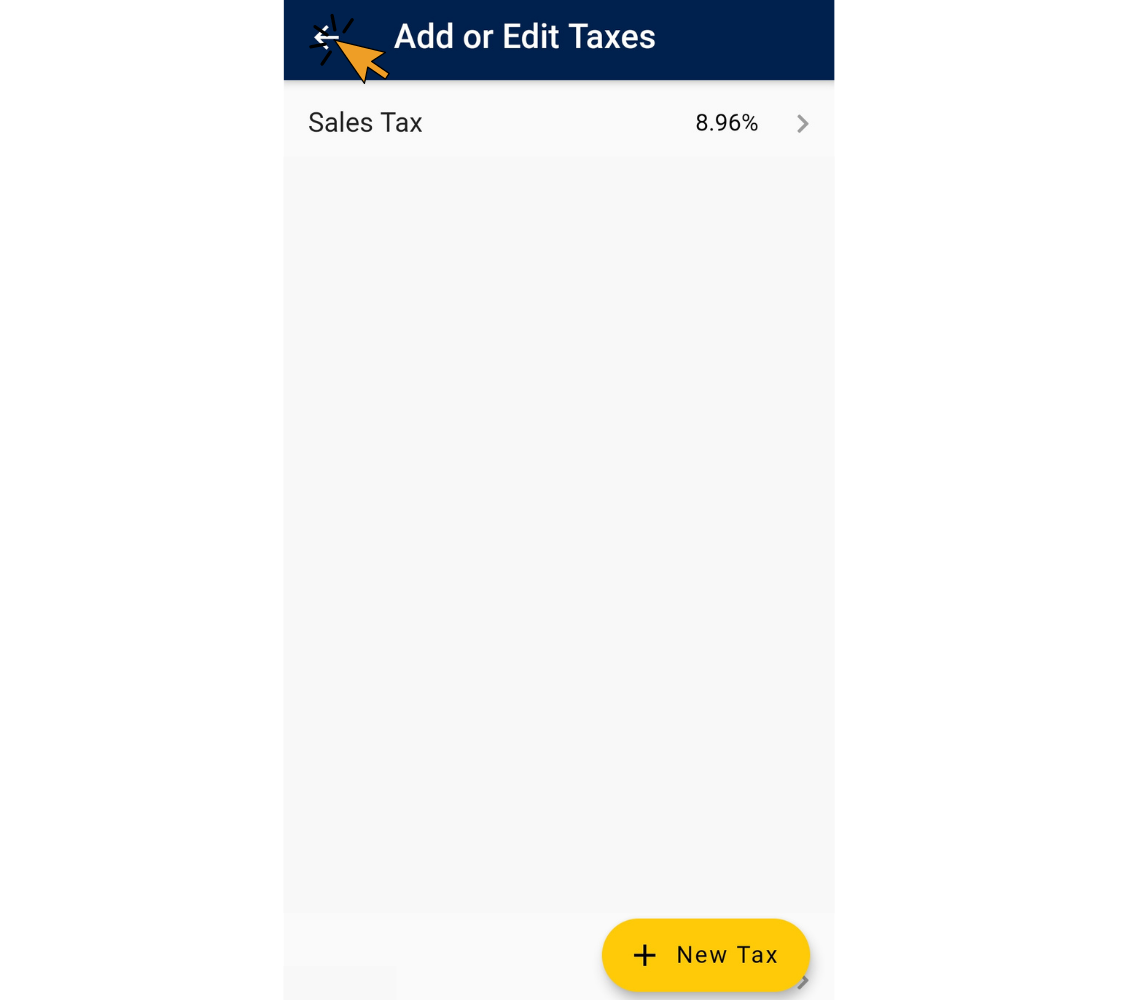

6. Tap “Add or Edit Taxes”

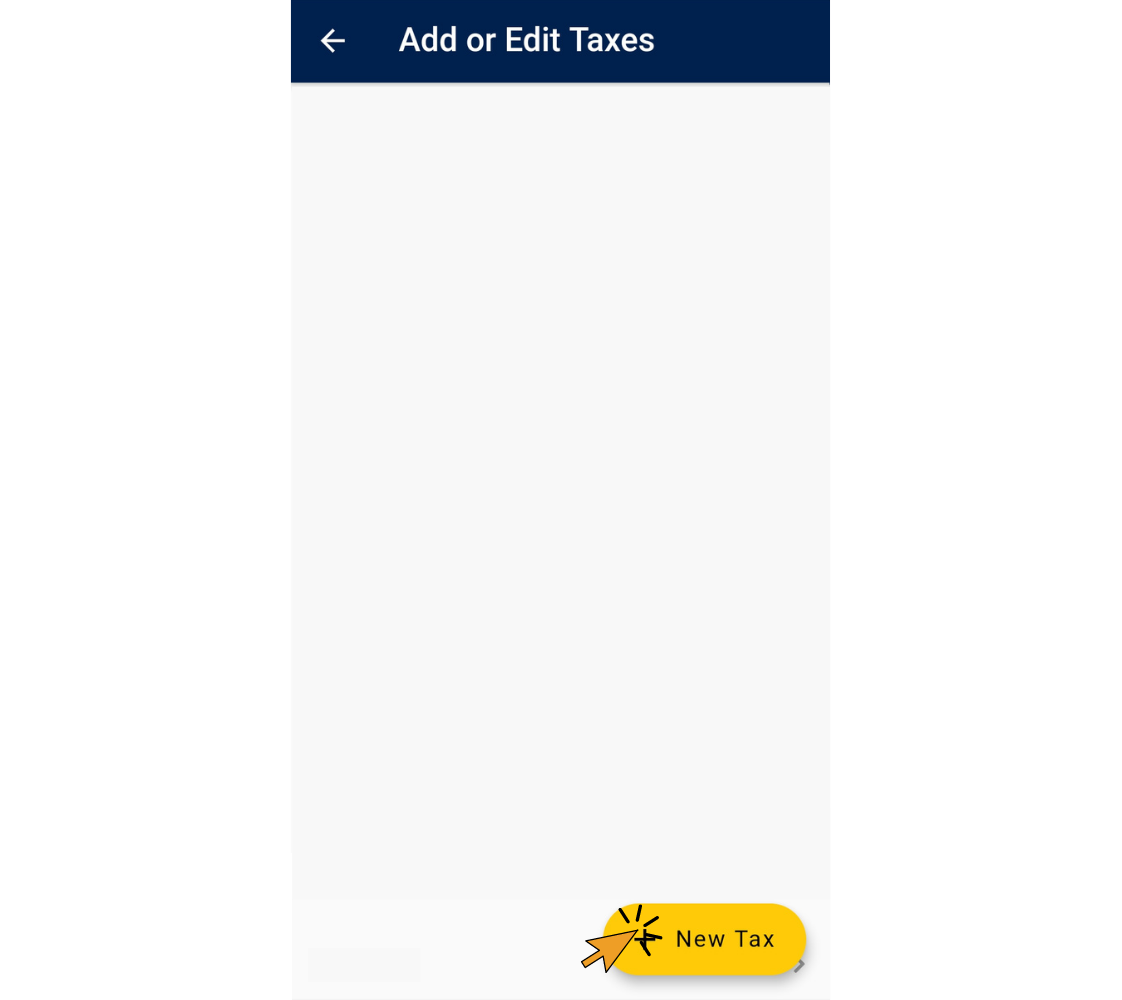

7. Tap “New Tax”.

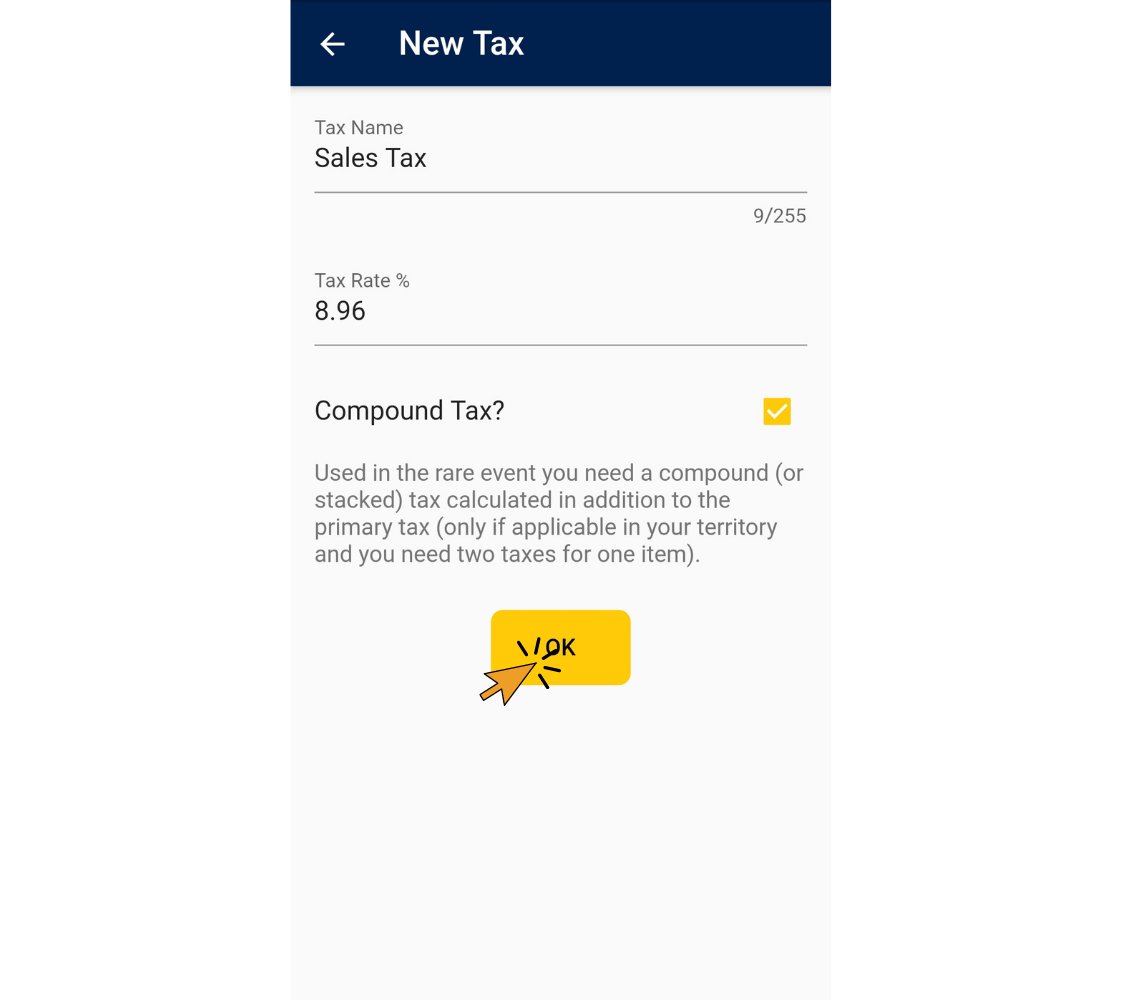

8. Enter “Tax Name”, “Tax Rate %”, and check the “Compound Tax?” box if it is a compound tax. Tap the “OK” button.

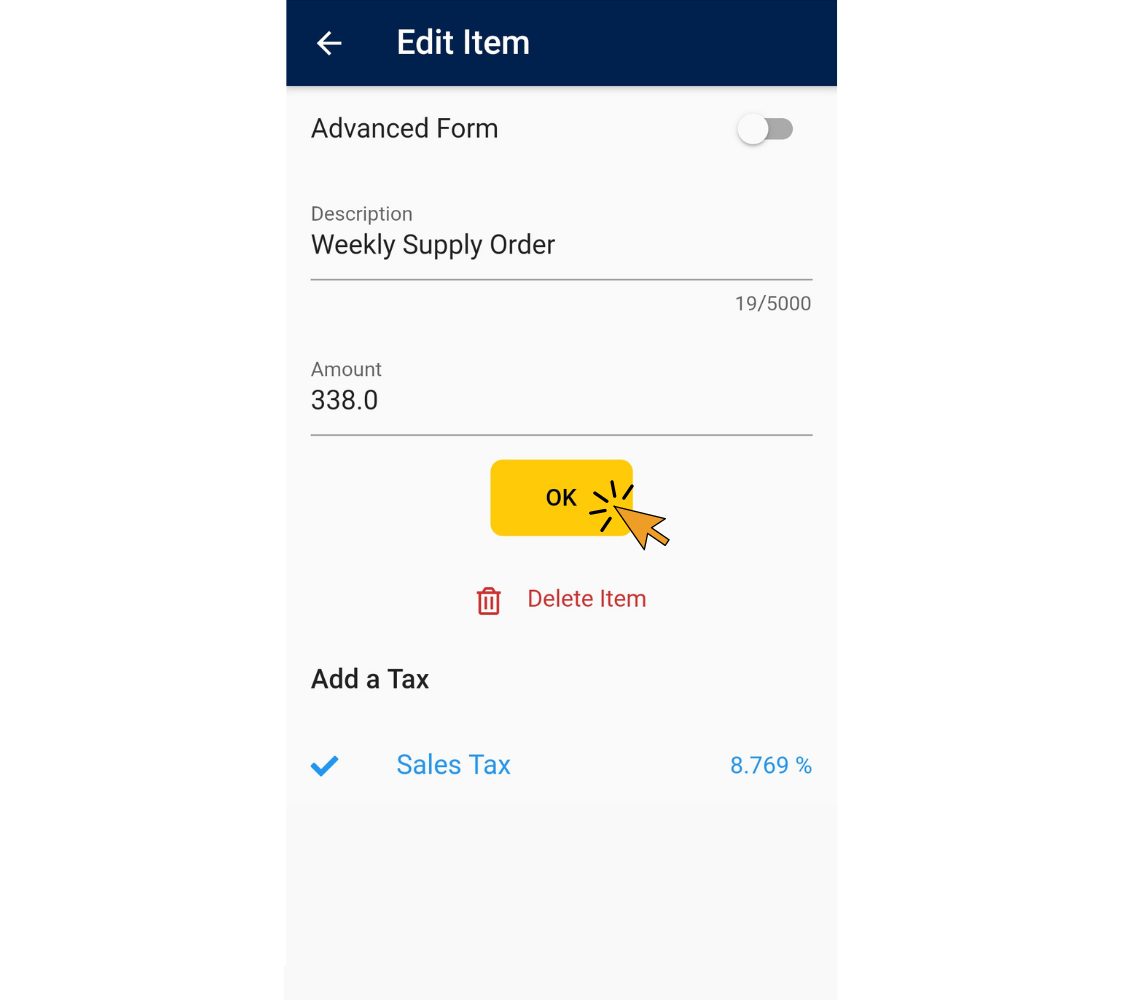

9. Tap “OK”.

10. Tap the back arrow in the upper left side of the screen.

That's it! You've added a taxable item to your invoice.

Here's How to Remove a Tax from an Item on Your Invoice

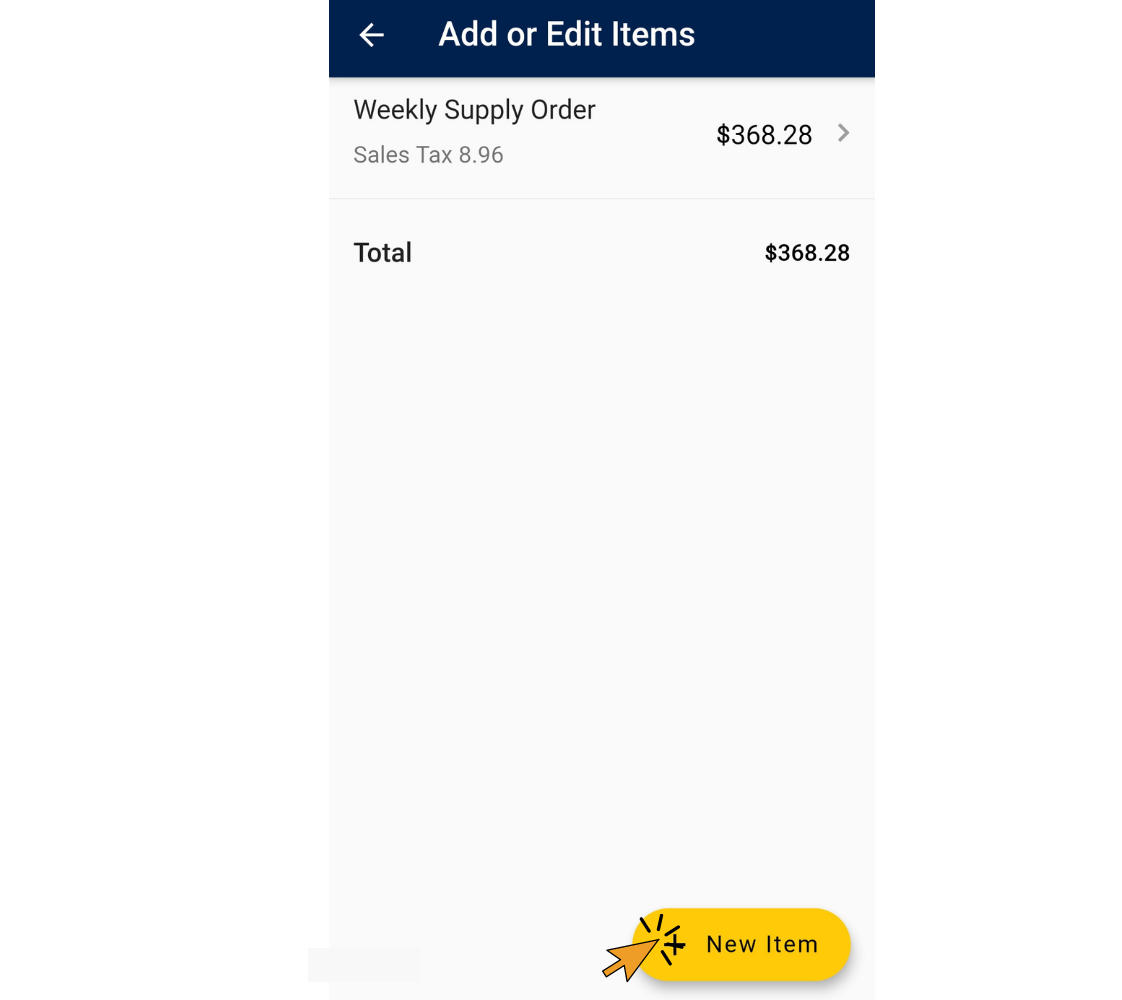

1. Tap “Add or Edit Items”.

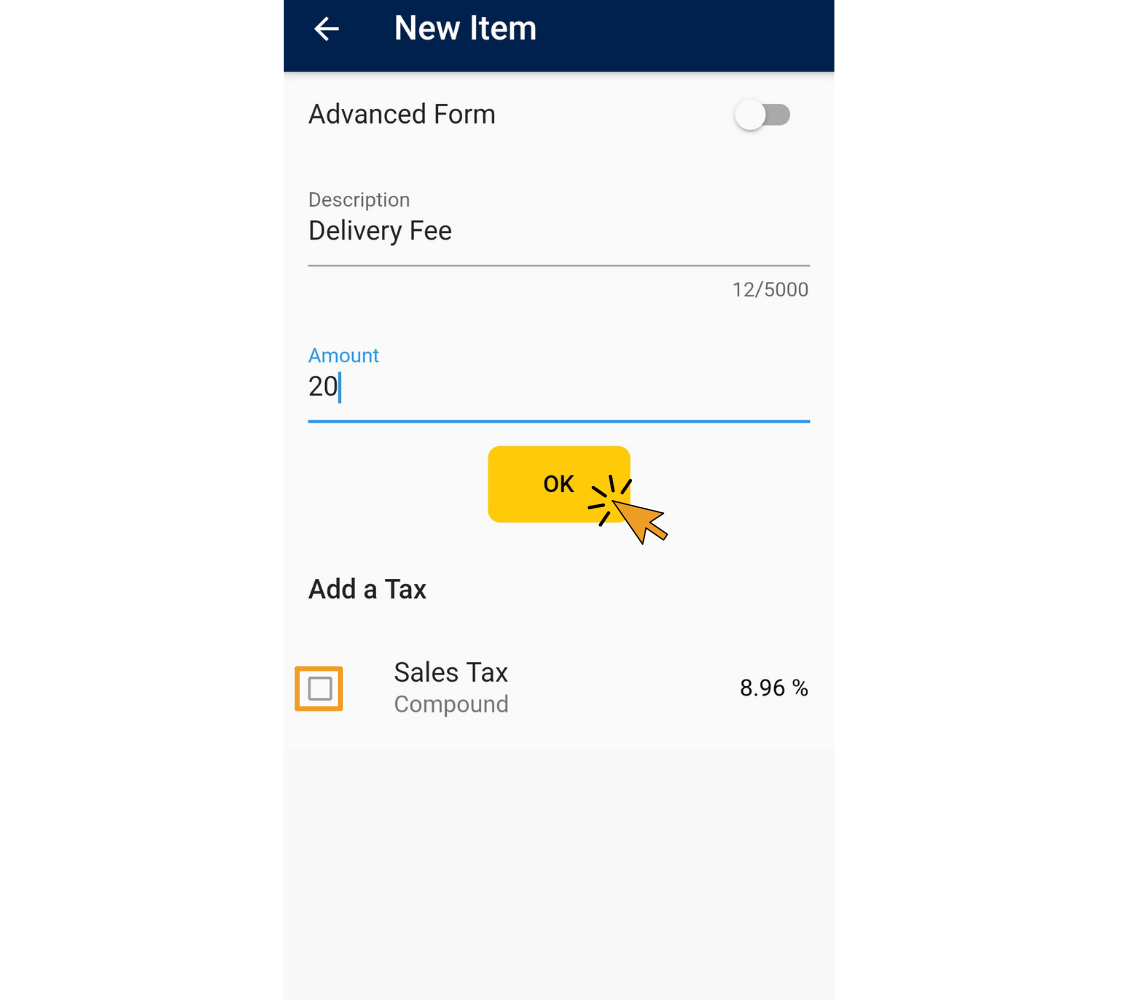

2. Tap “New Item”. The tax rate will be automatically added.

3. Enter the relevant details in the “Description” and “Amount” fields. Tap the box next to the tax with the blue check mark. Tap “OK”.

The tax is now removed from this item.

That's it! Now you have taxable and non-taxable items on one invoice.

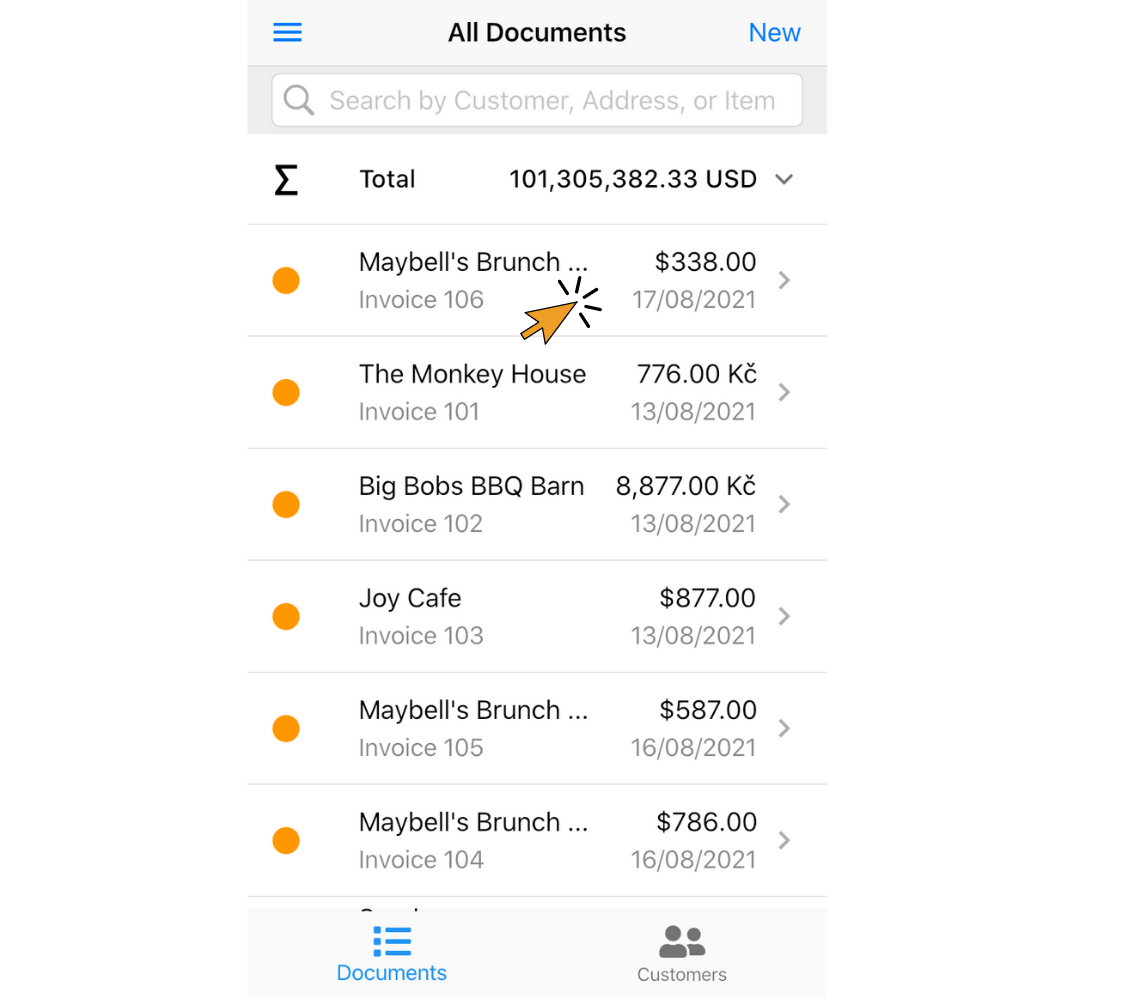

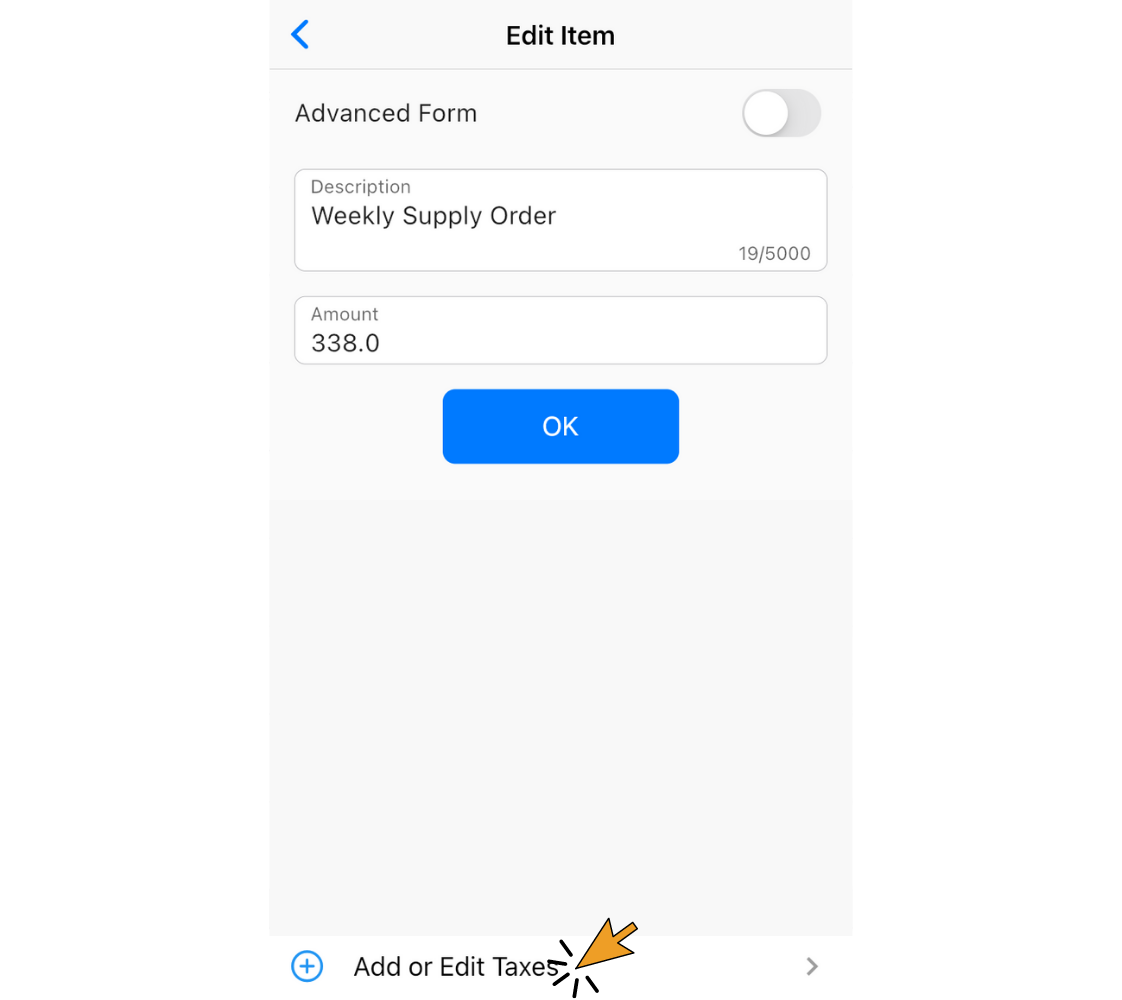

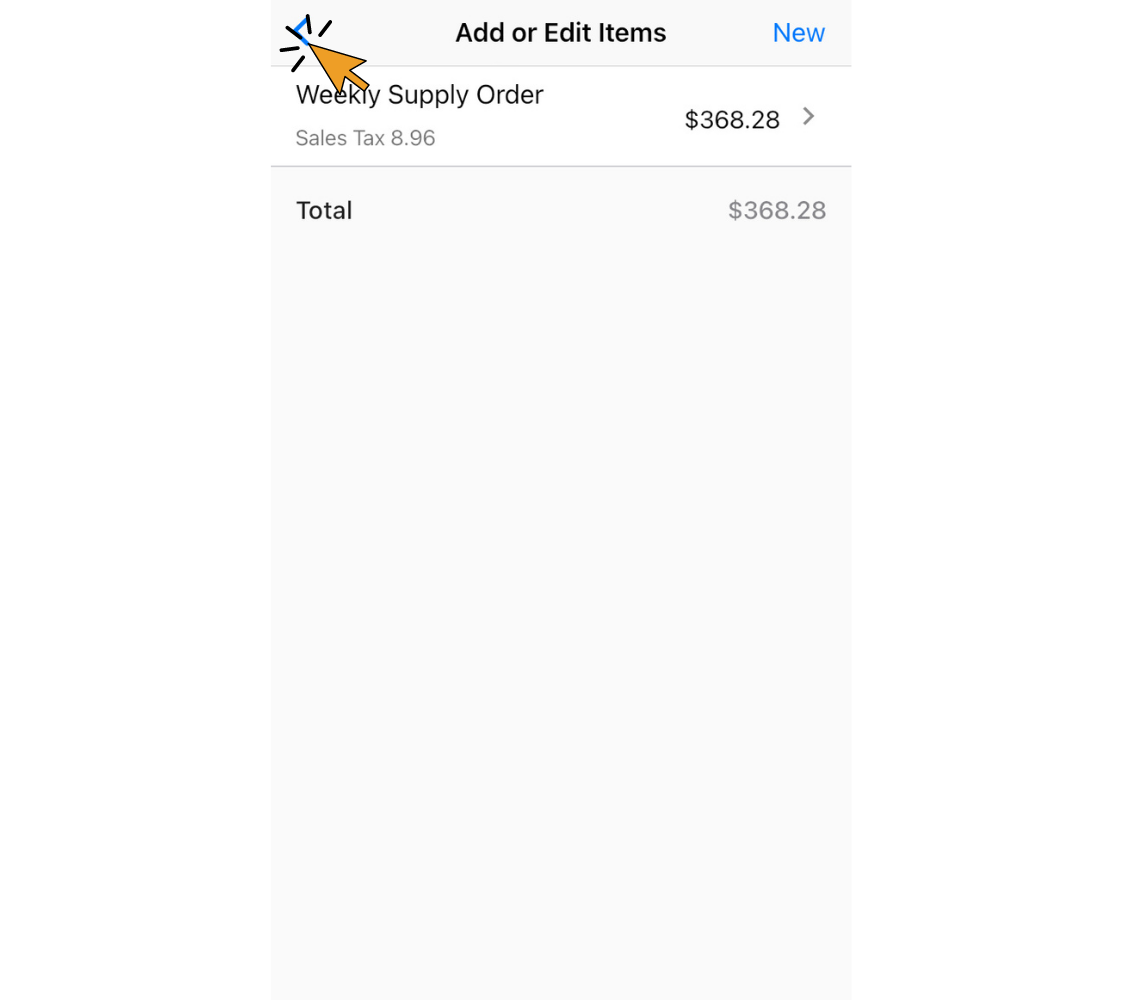

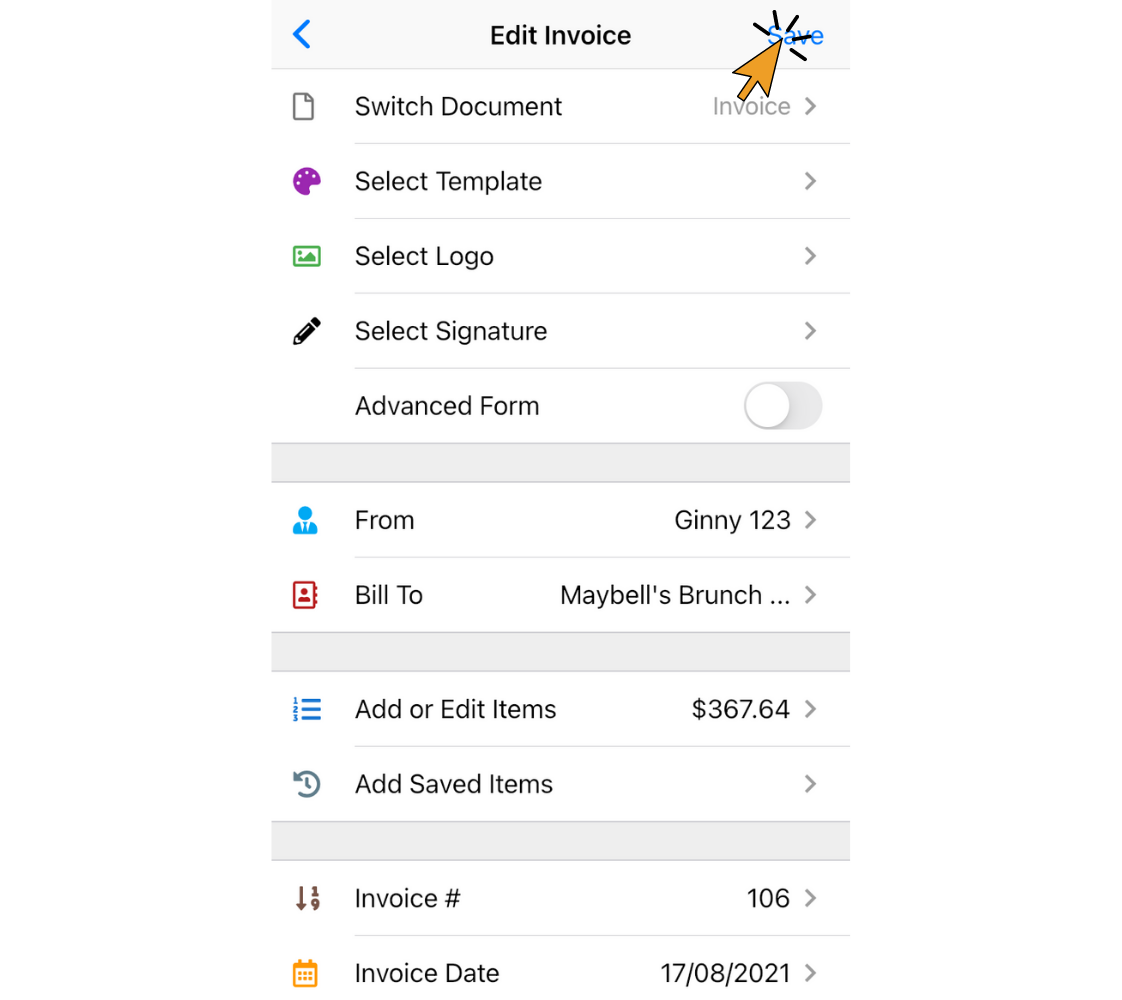

Invoice Home App - iOS

1. Open the Invoice Home App.

2. Tap on an invoice in your document list to open it, or create a new one.

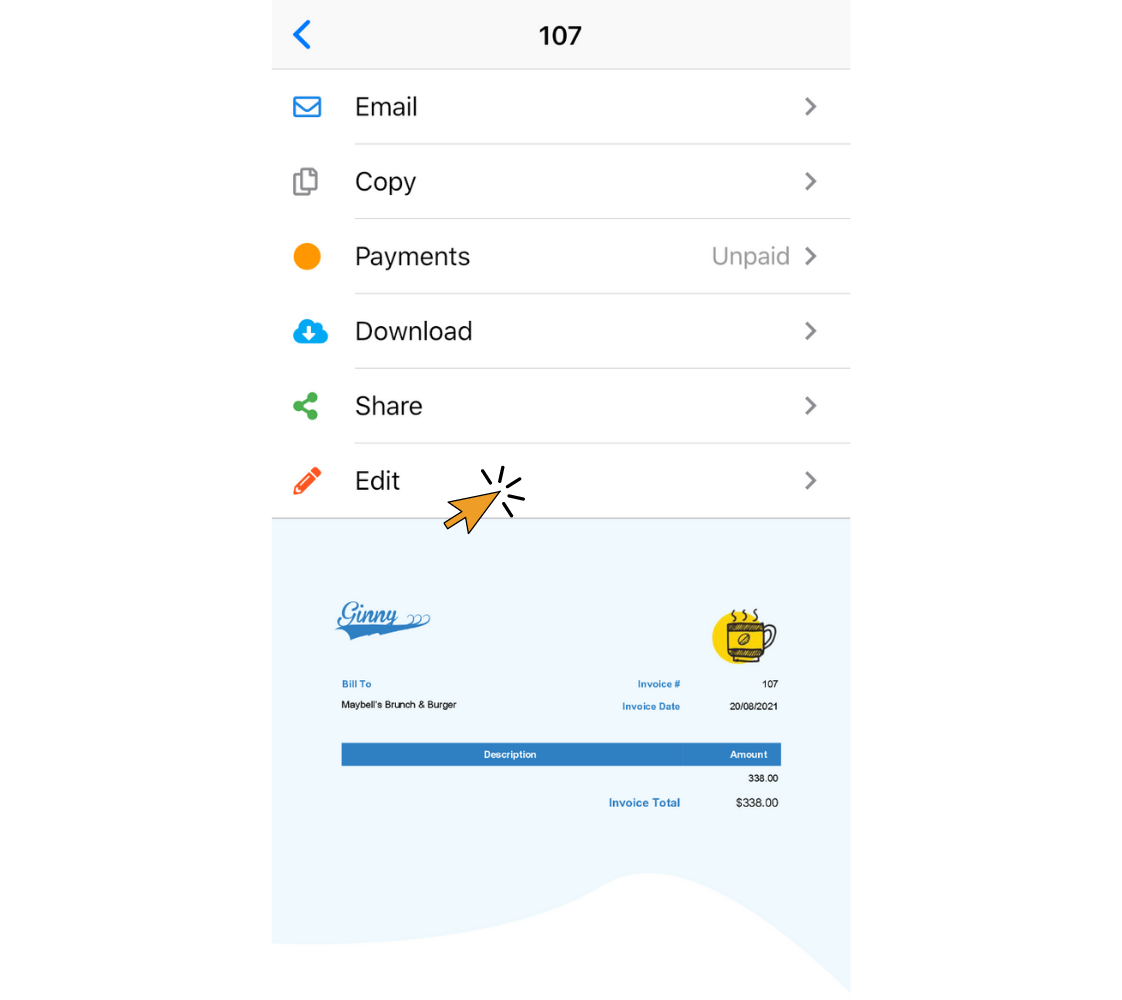

3. Tap the edit tab.

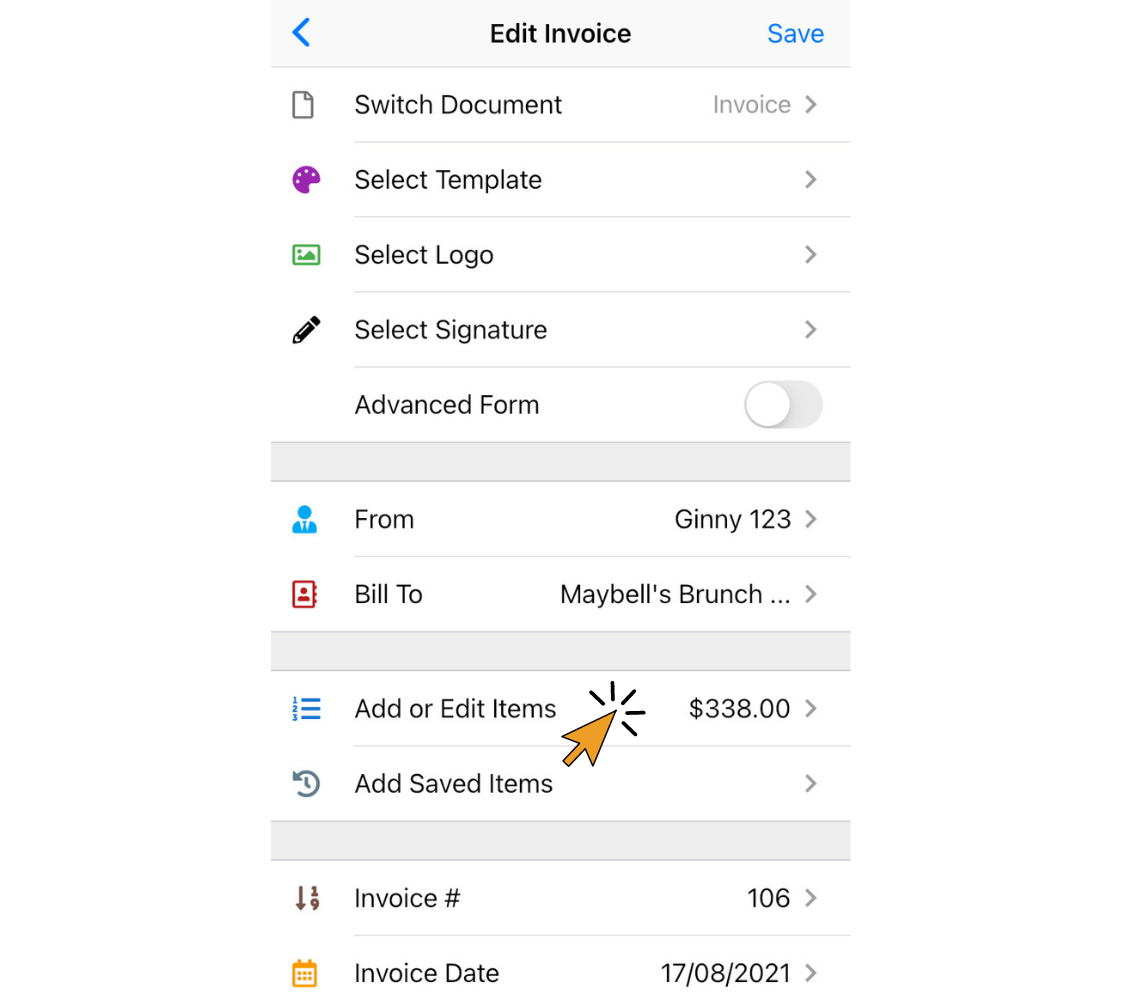

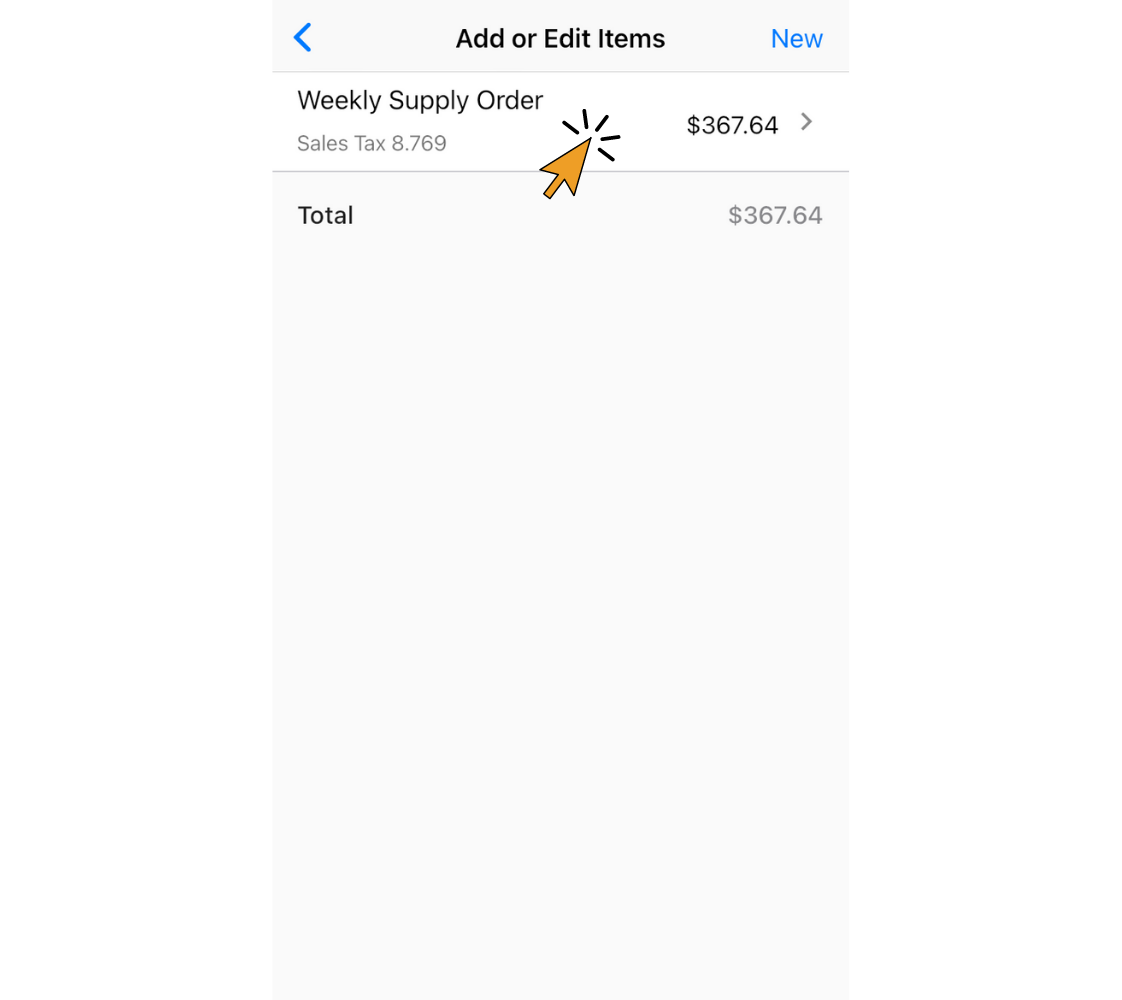

4. Tap “Add or Edit Items”.

5. Tap on the name of the item.

6. Tap “Add or Edit Taxes”

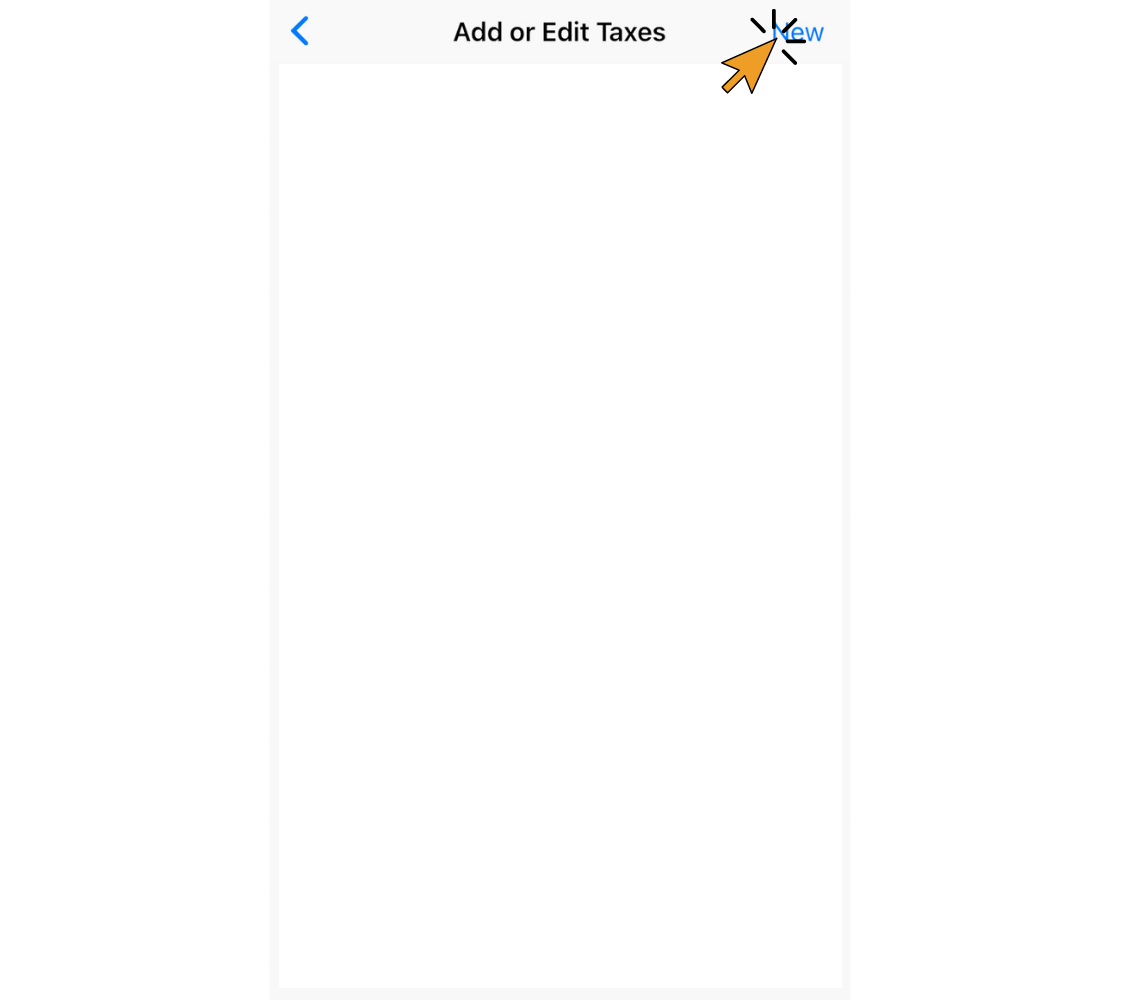

7. Tap “New”.

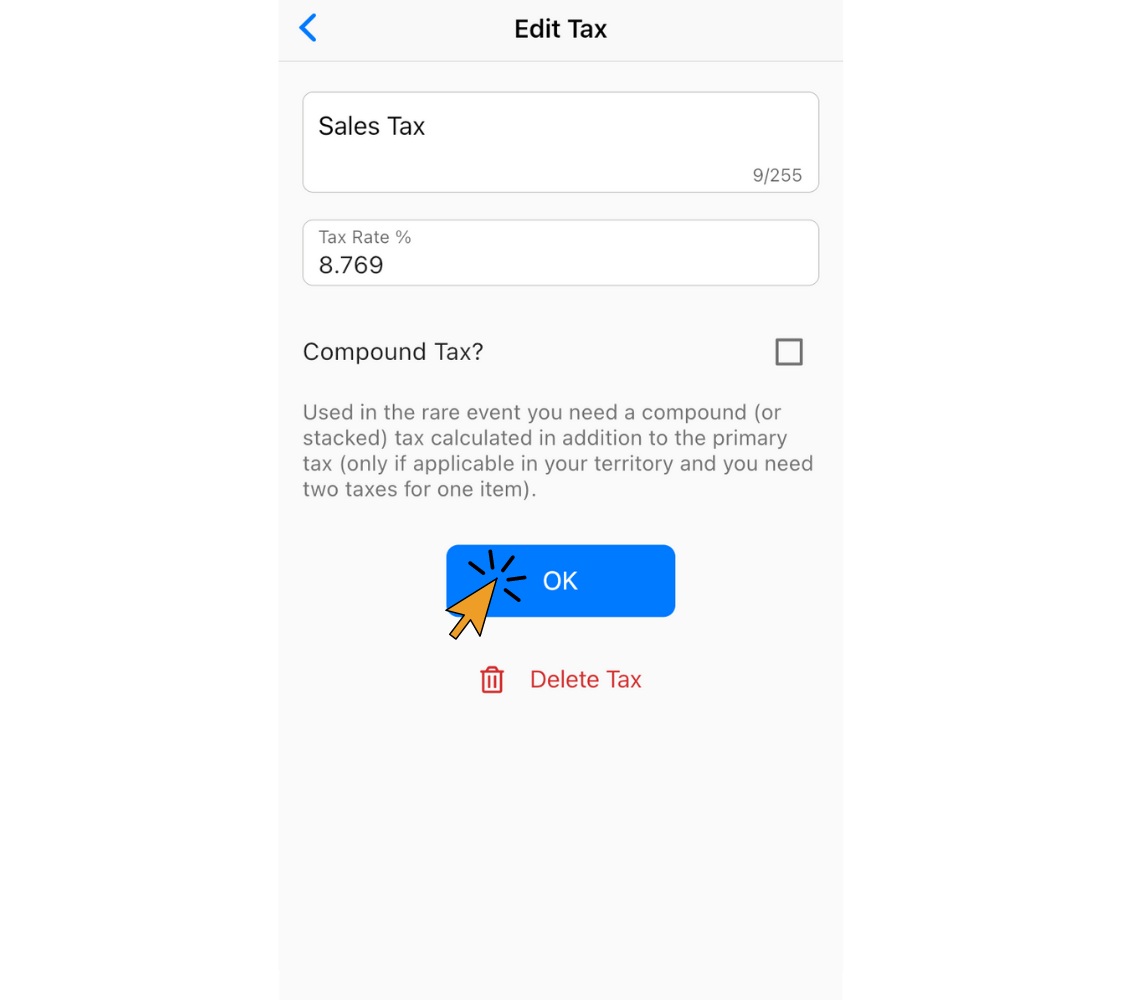

8. Enter “Tax Name”, “Tax Rate %”, and check the “Compound Tax?” box(if it is a compound tax). Tap the “OK” button.

9. Tap the “OK” button.

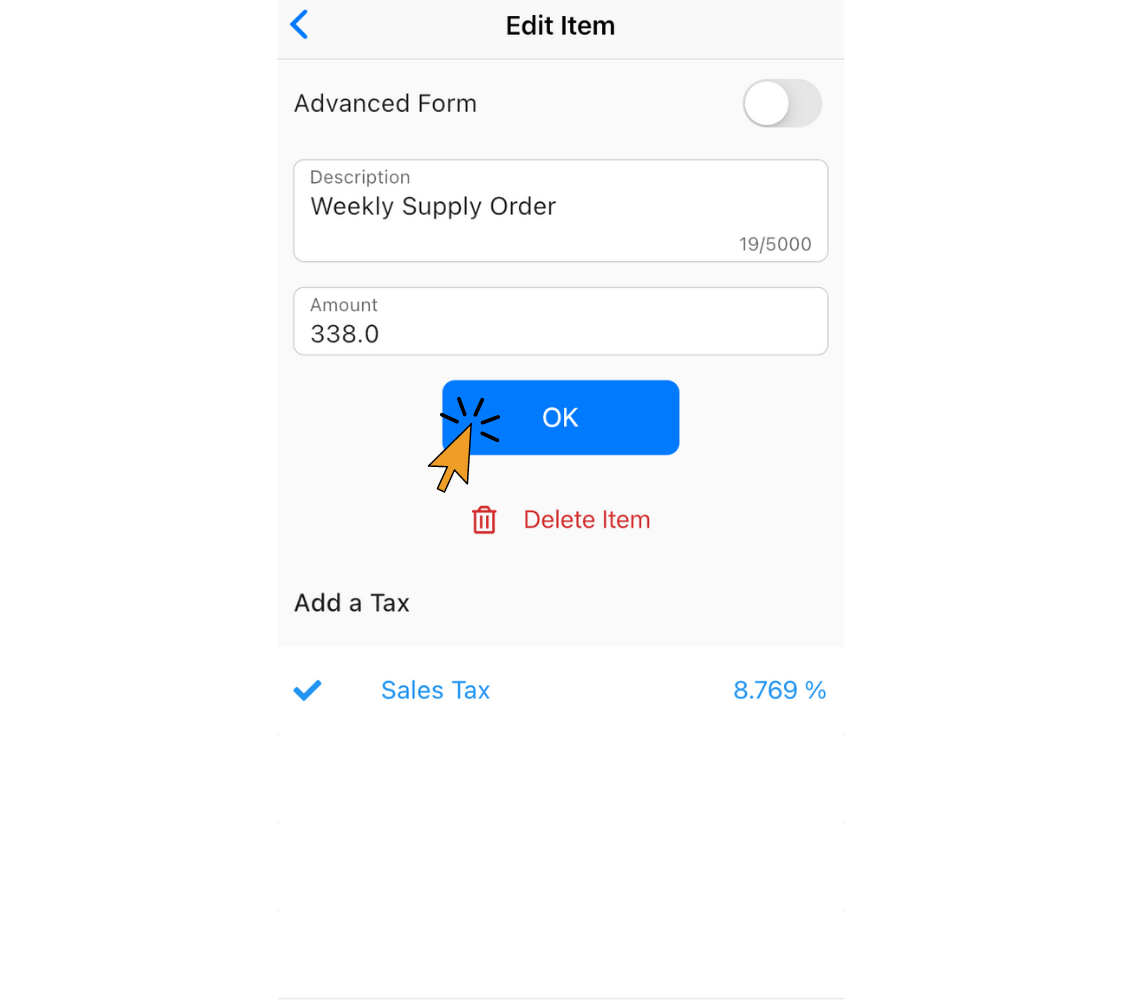

10. Tap the blue back arrow at the top left of the screen.

11. Tap “Save”.

That's it! You've added a taxable item to your invoice.

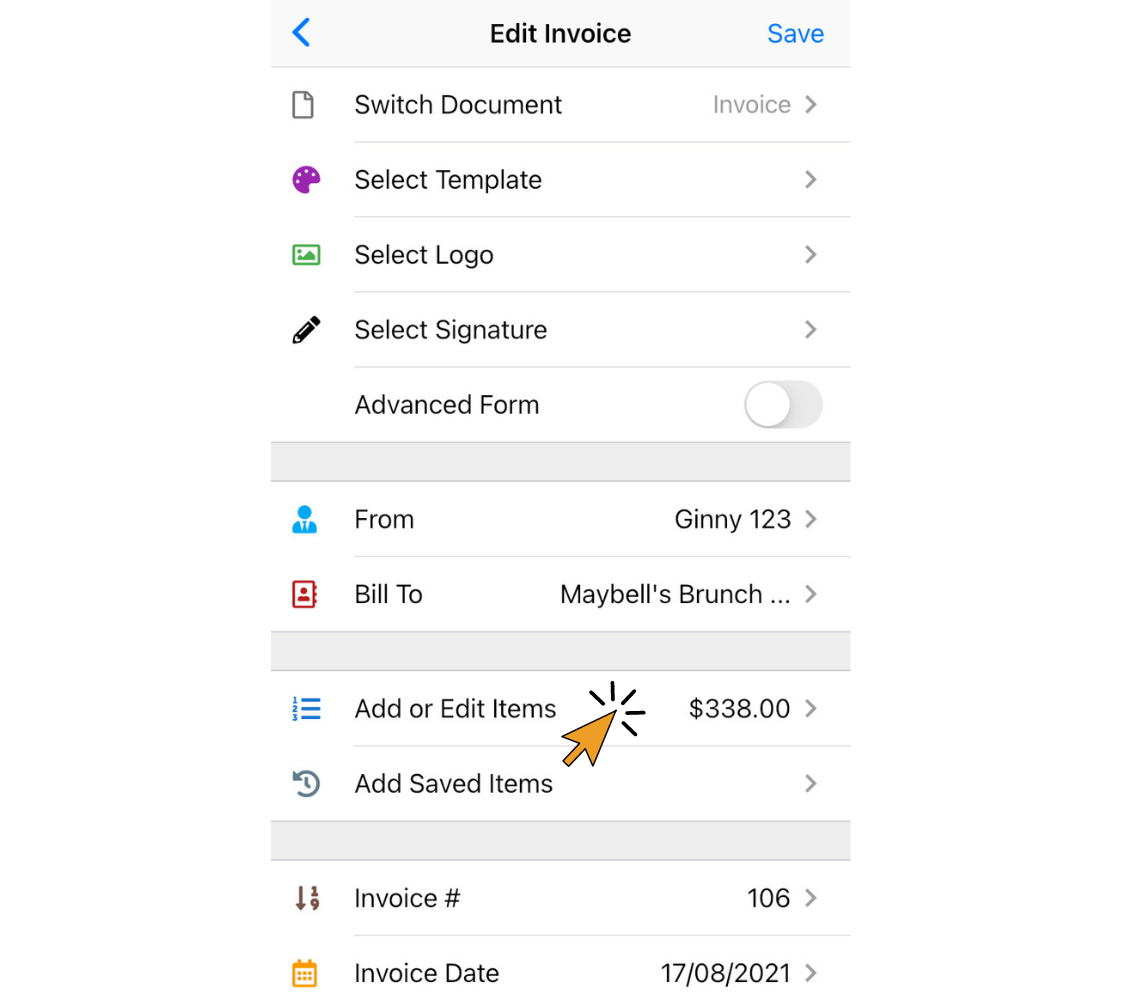

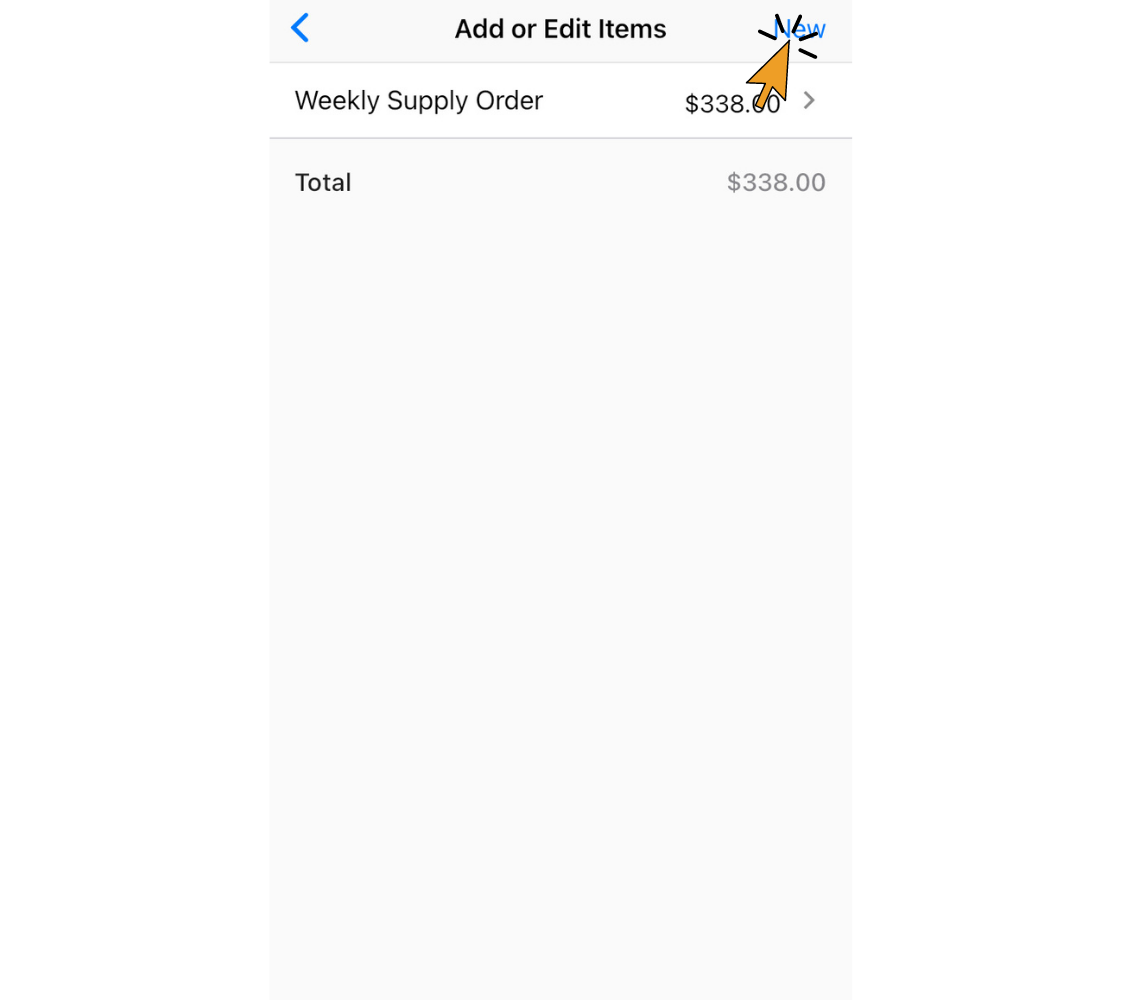

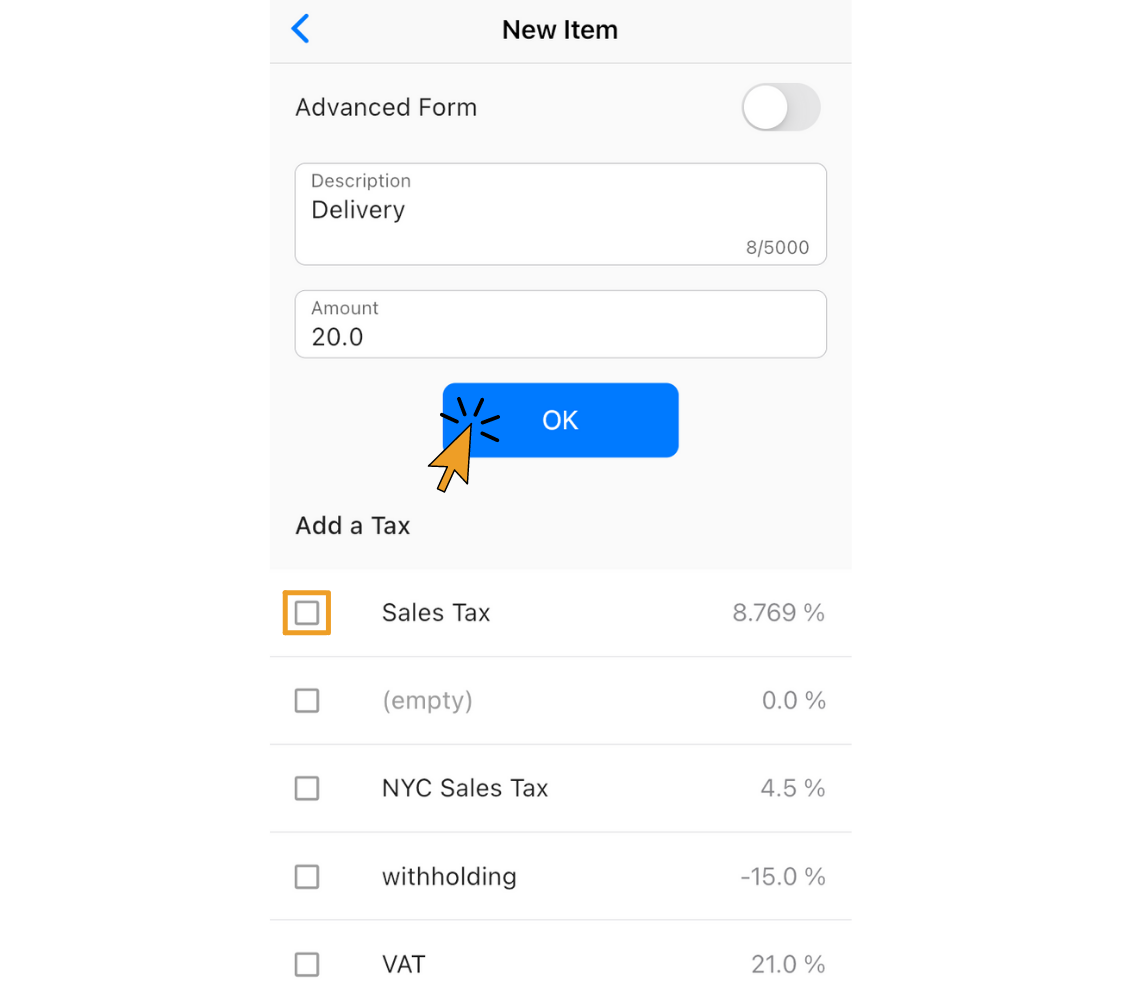

Here's How to Remove a Tax from an Item on Your Invoice

1. Tap “Add or Edit New Item”. The tax rate will be automatically added.

2. Tap “New”.

3. Enter the “Description” and “Amount”, and uncheck the box next to the tax. Tap “OK”.

The tax is now removed from this item.

That's it! Now you have taxable and non-taxable items on one invoice.

Thank you for using Invoice Home!